Introducing atai Life Sciences (NASDAQ: ATAI), A Well-Funded Mental Health Biotech Pioneering the Development of Potential Blockbuster Medicines Like Psychedelics for a Growing $380 Billion Market

The mental health crisis is out of control – and it’s getting worse

The global market size of mental healthcare was $380Bn in 2020 and is expected to grow to $509 Billion by 2028.

Mental health disorders are one of the largest global health burdens and were only exacerbated by the COVID-19 pandemic. According to the World Health Organization, 1 in 8 people worldwide – or 1 billion people total – now suffer from some form of mental health disorder.

Young people have been most affected, with teens suffering from unprecedented levels of sadness, increases in self-harm, overdoses, and suicidality. And most people do not receive the care they need.

Download Research Report

Answering that call is atai Life Sciences (Nasdaq: ATAI), a clinical-stage biotechnology company aiming to heal mental health disorders so that everyone everywhere can live more fulfilled lives

atai Life Sciences is a clinical-stage biotechnology company pioneering the development of novel mental health therapeutics. Founded in 2018 as a response to the significant unmet need and lack of innovation in neuropsychiatry, atai Life Sciences is dedicated to developing compounds with prior evidence in humans, particularly those that have been overlooked and not rigorously studied, such as psychedelics.

atai aims to develop treatments for large and underserved patient populations, including those living with cognitive decline associated with schizophrenia, anxiety, depression and substance use disorders.

atai’s cash position is the strongest in the psychedelic medicine space, with approximately $209M (as of September 30, 2023) and access to up to an additional $160M via term loan facility providing an anticipated runway into H1 2026.

With prominent backing from venture capitalists, including billionaires Peter Thiel and Christian Angermayer, atai Life Sciences ranks among the biggest biotech stocks focused on the development of mental health treatments.

atai Life Sciences takes a holistic approach to “treat the patient, not the condition.” A leader in the mental health space, the company is well equipped to deliver the next generation of mental health medicines

The Story

Co-Founded in 2018 by CEO Florian Brand, a serial entrepreneur named by Endpoints News, Business Insider and Fortune Magazine as a 20/30/40 under 40 in healthcare and biotech, this company began with a personal story.

After watching loved ones struggle with mental health issues, Brand realized that patients across the world were not getting the treatments they needed.

“Watching my best friend and business partner suffer, being let down by existing treatments and finally finding comfort in psychedelic therapies was all the inspiration I needed to commit my life to this cause.”

Florian Brand, CEO of atai

Investment Highlights:

- Large Market Potential: Mental health disorders are one of the largest global health burdens; global market size in mental health was $380Bn in 2020 and is expected to grow to $509bn by 2028.

- Clear Objective: atai’s objective is to achieve clinically meaningful and sustained behavioral change in mental health patients by developing rapid-acting and patient-centric pharmaceutical and digital treatment solutions.

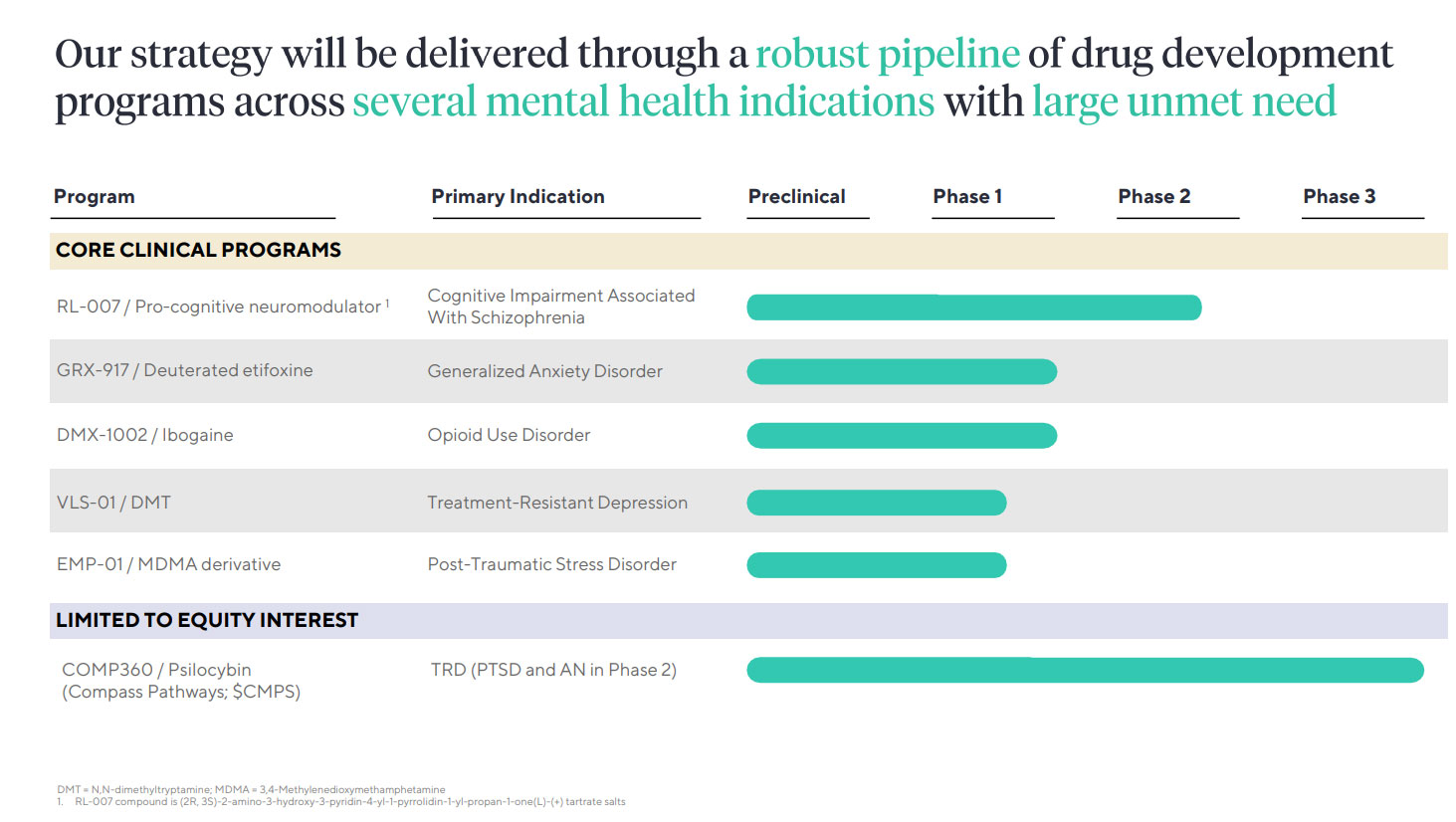

- Large Unmet Clinical Indications: atai's clinical pipeline is currently in development to treat large and underserved patient populations, including those living with cognitive decline associated with schizophrenia, treatment-resistant depression, anxiety, and substance use disorders.

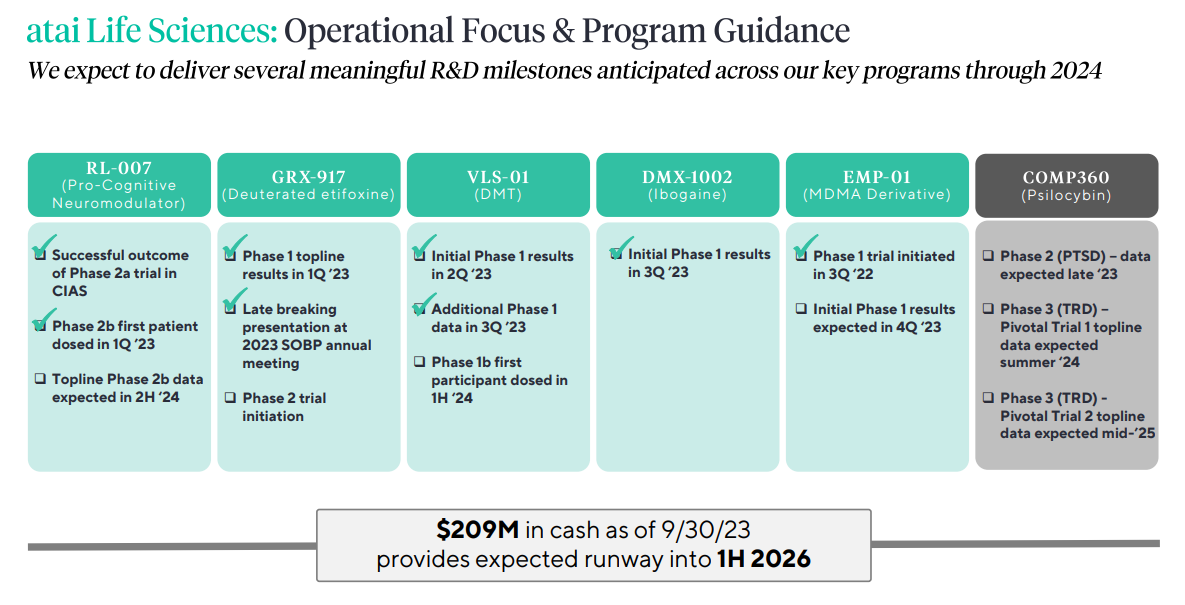

- Multiple Shots on Goal: atai has 5 clinical stage drug development programs with a focus on compound classes with prior evidence in humans. Its diversified platform approach helps avoid binary risk and optimizes likelihood of success.

- Significant Catalyst Event Potential: Company expects to deliver multiple R&D milestones anticipated across key clinical programs over next 2 years.

- Strong Cash Position: Approximately $209M (as of September 30, 2023) and access to up to an additional $160m term loan facility with Hercules Capital leads to anticipated cash runway into H1’26.

- Valuation Imbalance Opportunity: Market cap of ~$181M as of November 27, 2023 despite cash balance of $209m as of September 30, 2023, an approx. $55M stake in COMPASS Pathways as of March 17, 2023 and multiple clinical stage drug candidates in development.

- Strong Market Validation: Validation of atai’s operating model and ability to capture value: IPO of COMPASS Pathways in 2020 and licensing deal between Otsuka and atai subsidiary Perception Neuroscience in 2021.

- Compassionate Vision: To heal mental health disorders so that everyone everywhere can live a more fulfilled life.

We can change things. A future where families, friends, parents, sons, and daughters that we love have access to the help that they need. It’s the only future we will accept. And today, that future is one day closer. pic.twitter.com/rHUO9lRz2T

— atai Life Sciences (@atai_life) June 18, 2021

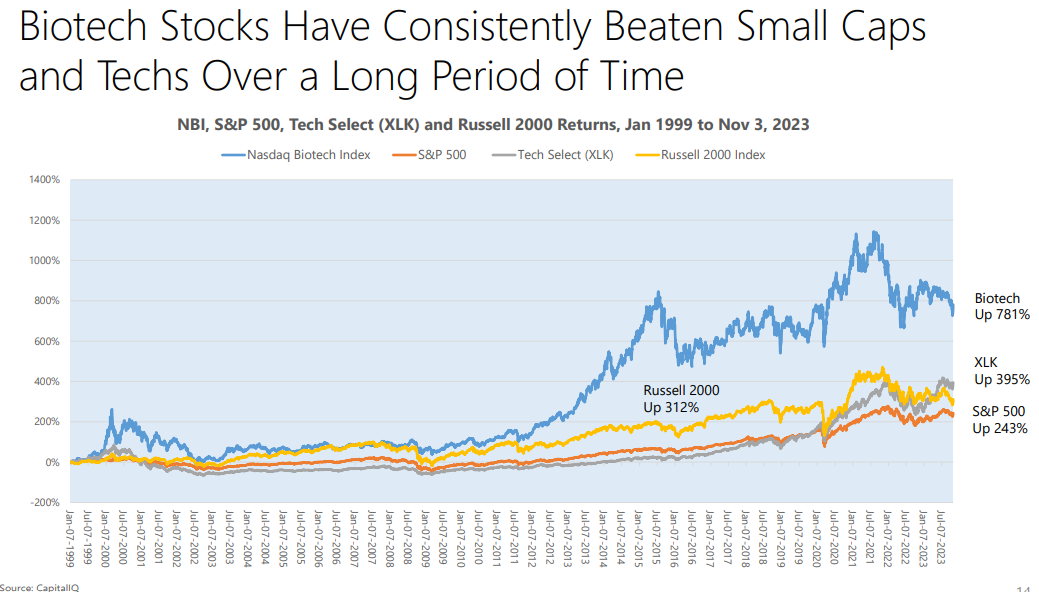

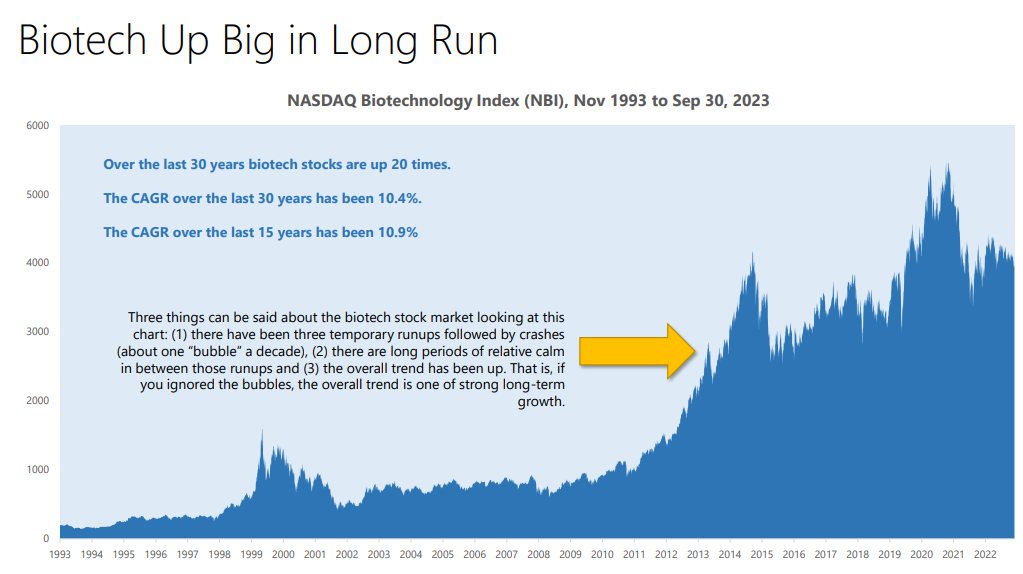

The latest Stifel report released November 2023 is bullish on investing in biotech.

- The healthcare sector is already a very large part of the economy.

- The “high tech” part of healthcare, particularly biotech, will continue to grow at a rate higher than the overall economy indefinitely.

- We are seeing a massive acceleration of underlying innovation and ongoing growth in demand to pay for the life extension associated with such innovation.

- The combined effect of these and many other innovations on life spans and the progress of human civilization will be profound.

atai Life Sciences tackles the mental health crisis with a unique de-risking approach focused on a diverse pipeline of compounds with prior evidence in humans

You can read more about the company’s programs HERE.

atai’s pipeline includes 5 clinical stage drug development programs with a focus on compound classes with prior evidence in humans; this approach involves a pharmacologically diverse pipeline to avoid binary risk while optimizing likelihood of success.

The Potential of Psychedelics

Psilocybin (a hallucinogenic compound) and DMT (a powerful and rapid acting psychedelic present in ayahuasca) have been highly buzzed about in the mental health arena for their potential long-lasting, highly effective treatments.

atai Life Sciences is embarking on the study of these and other drugs for their potential to effectively and rapidly treat many mental health disorders that are resistant to treatment.

🔊 Sound on 🔊

— atai Life Sciences (@atai_life) July 5, 2022

Listen to our CEO and CO-Founder @flobrand discuss the potential of psychedelics for the treatment of mental health with @MStothard pic.twitter.com/V0VzYBZOf2

$ATAI is a leader in the mental health biotechnology space as the company works to deliver on its clinical strategies with immense market potential.

Today, the global mental health market size has reached US$ 380 Billion. Looking forward, IMARC Group expects the market to reach $509 Billion by 2028, exhibiting a growth rate (CAGR) of 3.4% between 2023-2028.

The growing, underserved mental health space leads us to atai Life Sciences. The company has an innovative approach to solve the real and growing problem of mental health disorders with a unique digital approach.

Addressing Depression, Anxiety, Addiction, and other Mental Health Disorders with a compassionate mission, atai is zooming in on robust categories in the mental health treatment market.

Schizophrenia

Problem: Cognitive impairment is a core feature of schizophrenia for the 24m people who live with it. 98% of patients with schizophrenia perform worse on cognitive tests than expected. There are no FDA approved therapies for Cognitive Impairment Associated with Schizophrenia (CIAS).

atai's answer: atai is investigating RL-007, a novel compound that has shown pro-cognitive effects in numerous Phase 1 and 2 studies.

Anxiety

Problem: Anxiety disorders are the most comment mental health concern in the United States and not only do less than half of those affected receive treatment, but currently approved medications come with significant side effects and/or risk of dependence.

atai’s answer: atai is investigating deuterated etifoxine, a patent protected version of etifoxine, a drug approved for anxiety in more than 40 countries with benzodiazepine-like effects but without the sedative effects and addictive potential.

Depression

Problem: Depression affects more than 300m people and is the 2nd leading cause of disability worldwide. Only about 1/3 of patients respond to existing treatments and standard-of-care drugs like SSRIs come with significant side effects ranging from weight gain to suicidality.

atai’s answer 1: COMP360 (patented protected synthetic psilocybin) is in late-stage studies for treatment-resistant depression.

atai’s answer 2: atai is studying VLS-01 (oral thin film DMT) for treatment-resistant depression.

Substance Use Disorder

Problem: Over 20m people live with a substance use disorder (SUD) in the US. Since the drug epidemic started in 1999, there have been over 900,000 overdose fatalities. For an already vulnerable population, COVID-19 severely exacerbated the crisis for those with a SUD. Drug overdose deaths shot up ~30% with close to 93,000 deaths in 2020, nearly 70,000 of which involved opioids. With only 2 FDA approved treatments for OUD, options are limited, and relapse rates are as high as 75%.

atai’s answer: atai is studying DMX-1002, an oral formulation of ibogaine, a naturally occurring psychedelic compound isolated from a West African shrub. In uncontrolled studies, Ibogaine has demonstrated rapid and sustained efficacy for OUD.

atai Life Sciences has a market cap of ~$181M as of November 27, 2023 despite cash balance of $209m as of September 30, 2023, an approx. $80M stake in COMPASS Pathways as of March 17, 2023 and multiple clinical stage drug candidates in development that tackle the mental health crisis

With its diverse pipeline of drugs and a focus on compounds with prior evidence in humans, upcoming inflection points (multiple Phase 1 and Phase 2 proof-of-concept trial readouts are expected in the next two years), a world-class team of executives and researchers, and financial runway into 2026, now is the time to pay attention to atai Life Sciences.

Watch our CEO, @flobrand, talk about who we are and why we come to work every day⬇️#MentalHealth #Innovation #Hiring pic.twitter.com/gWLA6niPNQ

— atai Life Sciences (@atai_life) June 1, 2022

In Conclusion

$ATAI is a leading biotech company aiming to transform the treatment of mental healthcare, a market that is expected to grow to $509bn by 2028.

Backed by prominent venture capitalists, including Peter Thiel and Christian Angermayer, atai Life Sciences has 5 clinical stage programs aimed at large and underserved patient populations.

atai Life Sciences' unique de-risking approach focuses on a diverse pipeline of compounds that have prior evidence in humans, positioning the company well as an emerging leader in the mental health space.

atai Life Sciences (Nasdaq: ATAI) is a leading biotech with a novel de-risked approach to addressing the mental health crisis. The company has a current market cap of~ $181M (11/27/23) and is currently trading under its cash position of $209M (September 30, 2023). This could increase significantly if its programs continue to be successful.

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

SCD Media LLC (d/b/a “Smallcaps Daily”), hearinafter referred to as “Smallcaps Daily,” and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party”. The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation”.

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Smallcaps Daily, its managers, its employees, affiliates, and assigns (collectively the "Publisher") do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

Release of Liability: through use of this website, viewing or using you agree to hold Smallcaps Daily, its operators, owners, and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Smallcaps Daily encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the company profiled or is available from public sources and Smallcaps Daily makes no representations, warranties, or guarantees as to the accuracy or completeness of the disclosure by the profiled company. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Smallcaps Daily strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Smallcaps Daily’s full disclosure is to be read and fully understood before using Smallcaps Daily's website, or joining Smallcaps Daily's email or text list. From time to time, Smallcaps Daily will disseminate information about a company via website, email, sms, and other points of media. By viewing Smallcaps Daily's website and/or reading Smallcaps Daily's email or text newsletter you are agreeing to this ----> https://Smallcaps Daily.com/disclaimer/. All potential percentage gains discussed in any communications are based on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising companies for monetary compensation.

If you have questions or concerns about a product you’ve seen in one of our emails, emails, text newsletters or SMS, we encourage you to reach out to that company directly.

Disclaimer – Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated, and edited by the owner of Smallcaps Daily. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to Smallcaps Daily. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Companies with low prices per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website. We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares, we will list the information relevant to the stock and the number of shares here.

COMPENSATION

In compliance with section 17(b) of the Securities Act we are disclosing that we have been compensated a fee pursuant to an agreement between Smallcaps Daily and TraDigital Marketing Group, Inc. (d/b/a/ “TraDigital IR”) hereinafter referred to as TraDigital IR. Please see TraDigital IR’s disclosure page here. Smallcaps Daily was hired by TraDigital IR for a period beginning March 2023 and ending December 2023 to publicly disseminate information about Atai Life Sciences, N.V., via website, email, and SMS. We were paid forty-three thousand USD via ACH. Readers are advised to review SEC periodic reports: forms 10Q 10K, form 8K, insider reports, forms 3, 4, 5 schedule 13d. Smallcaps Daily is compliant with the CAN-SPAM Act of 2003. Smallcaps Daily does not offer investment advice or analysis, and Smallcaps Daily further urges you to consult your own independent tax, business, financial, and investment advisors. investing in micro-cap, small-cap, and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. The private securities litigation reform act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or performance are not statements of historical fact but may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results in preparing this publication. Smallcaps Daily has relied upon information supplied by its clients, as well as its clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can not be guaranteed. Investors should not rely on the information contained on this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, Smallcaps Daily and its owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Smallcaps Daily is not responsible for any claims made by the companies advertised herein, nor is Smallcaps Daily responsible for any other promotional firm, its program, or its structure. Smallcaps Daily is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission, or FINRA.

Atai Life Sciences, N.V. is a client of TraDigital IR, an investor relations and communications firm. Please see TraDigital’s disclosures at www.tradigitalir.com.

Copyright © 2022 Smallcaps Daily. All rights reserved.