This Rising Financial Tech and Social Media Hybrid Company Just Announced a Stock Repurchase Program of up to $2.5M!!

As more and more people turn to the stock market for retirement plans and extra income, emerging fintech company Blackboxstocks, Inc. (NASDAQ: BLBX) is positioned to rapidly hit the spotlight!

Blackboxstocks, Inc. is a financial technology and social media hybrid platform offering real-time proprietary analytics and news for stock and options traders of all levels.

The company’s web-based software employs "predictive technology" enhanced by artificial intelligence to find volatility and unusual market activity that may result in the rapid change in the price of a stock or option.

Blackboxstocks, Inc. (NASDAQ: BLBX) is an exciting company to have on your radar as the company gains attention for its innovative social media platform that is geared towards traders at ALL levels of experience!

Did you know Investors have put more money into stocks last year than the previous 12 years combined?

Statistics from Bank of America reflects a period in which the Dow Jones Industrial Average has risen more than 26%!

Easier and newer ways of trading are becoming much more desired as the younger generations’ interest in trading grows.

MagnifyMoney found that almost 6 in 10 Gen Z and Millennial investors (age 40 and younger) are members of investment communities or forums, such as Reddit, and nearly half have turned to social media for investing research.

Blackboxstocks’ interactive social media platform is innovative and fresh, and geared to newer traders and those who often turn to social media platforms such as Reddit or Twitter for advice!

This is just ONE reason to have BLBX on your radar!

BLBX’s Board of Directors has also recently approved a stock repurchase program for up to $2.5 million of the Company’s common stock!

"This stock repurchase program demonstrates management’s confidence in our business prospects and enables us to purchase shares at what we believe to be a significant discount to their intrinsic value. "We believe we can leverage the strength of our balance sheet to execute this plan without impeding any of our growth initiatives."

Robert Winspear, Chief Financial Officer

Earlier this year, the company additionally achieved a huge milestone!

BLBX announced that they crossed the threshold of 6,000 active paid subscribers!

Not only that, but Q4 revenue reached a 45% - 50% increase, resulting in a new high record!

"We are just getting started. With our unique platform, we believe that Blackbox is well positioned to cater to the explosive democratized trading movement!”

- Gust Kepler, Chief Executive Officer

MORE REASONS TO HAVE BLBX ON YOUR WATCH-LIST INCLUDE:

- Gen Z and Millenials are trading more often than before, Online broker Charles Schwab gained a record 4 million new clients last year, more than half of the new investors are under the age of 40. In fact, Americans opened 10 million new brokerage accounts in 2020 and more than half of them came from millennial favorite Robinhood.

- Social Media use within trading stocks has become a trend amongst young traders and investors. Typically they use Twitter, YouTube, Instagram, TikTok, and other platforms as virtual trading clubs to exchange ideas, promote stocks, and gain financial advice. Furthermore, a study from Greenwich Associates shows that almost 80% of institutional investors use social media as part of their regular work flow, and approximately 30% of these investors say information obtained through social media has directly influenced an investment recommendation or decision.

- The global financial technology market is expected to grow and reach a market value of approximately $324 billion by 2026, with a CAGR of about 23.41% over the forecast period of 2021-2026.

- The social media market is constantly growing, with the global social networking platforms market evaluated at US $192.950 billion for the year 2019 and is projected to grow at a CAGR of 25.38% to reach a market size of US $939.679 billion by the year 2026.

- Companies like Robinhood, have made millions off of young Americans who have begun investing in recent years. The ease of trading has turned it into a cultural phenomenon and Robinhood climbed to an $8.3 billion valuation. It has been one of the tech industry’s biggest growth stories in the recent market turmoil!

Keep on reading to discover why BLBX is an exciting fintech company to have high on your watch-list right now!

Greetings Investors,

Fintech startups are transforming financial services for many years to come. The explosion of innovation in Fintech is incredibly exciting. This is a booming arena.

According to CB Insights, the space had raised $13.4 billion in the first quarter of 2021.

It was last year that Robinhood filed for its IPO and in a post on its app, Robinhood said 301,573 users participated in the IPO, which raised about $2 billion and valued the company at $32 billion!

As the tech savvy millennial generation has aged, banking and financial options evolved and more and more people are interested in what their money can do for them through investing.

Numbers don’t lie, nearly 6 in 10 investors 40 years or younger are members of investment communities or online social forums such as YouTube, Reddit, Twitter, and more.

Online is where young investors come to find information and tips. One of the credits to turning younger generations to trading is Robinhood, a trading app that is geared to making trading simple and free.

What happened with GameStop in 2021 was HUGE. It showed everyone that young investors can move markets.

However, this runs a lot deeper than the new kids getting rich off a short squeeze. The fact is, the largest generation in American history, Millennials, are diving into the stock market for the first time ever!

This is exciting as their top four holdings surged 570%, 69%, 66%, and 1,405% over the past year!

Source: SurveyMonkey

According to a recent survey, over half of Gen Z and millennial investors said their risk tolerance has grown since the coronavirus pandemic began. Only 28% of all respondents said the same. In addition, over half of investors below the age of 34 are also trading stocks more frequently throughout the pandemic.

Within these communities however, there is plenty of risk involved. Many inexperienced traders are often left devastated by their lack of education of the stock market. According to an article by The New York Times, “More than at any other retail brokerage firm, Robinhood’s users trade the riskiest products and at the fastest pace.”

Without the tools and a community to rely on, investing can become risky and result in devastating losses.

This is where Blackboxstocks, Inc. (NASDAQ: BLBX) enters the equation….

Headquartered in Dallas, TX, the company is dedicated to being the most user-friendly stock and options tool on the market!!

BLBX offers real-time education for its users in a community of some of the TOP traders!

Their system automatically posts symbols alerting users to explosive opportunities in the market in real time.

BLBX knows that trading can be confusing and overwhelming to first-time traders, which is why they offer their members a variety of free classes to help educate and guide for the best possible outcome!

With proper education and tools that new investors need, user-friendly, all level trading tools “democratize finance”, which is the reduction of inequalities of income, wealth, and power. All this to say, trading and investment made simple and accessible for everyone.

Financial Technology, or Fintech, subdivides the functions provided by current financial institutions and uses technology to automate, realize low-cost and high efficiencies. FinTech applies the evolution of IT to all kinds of financial services and it eliminates "non-efficiency" as much as possible. It solves the problem of speed, so that users can use the service cheaply and conveniently, making it accessible for all.

Due to the cost reduction, all kinds of financial services that were only available to the wealthy, upper class, have become available to the everyday public.

The need for an easy to bite off, educational, and interactive trading tool is at an all-time high which turns an eye to Blackboxstocks, Inc. (NASDAQ: BLBX)!

ABOUT THE COMPANY

Blackboxstocks, Inc. is a Nevada corporation headquartered in Dallas, Texas and is a financial technology and social media hybrid platform offering real-time proprietary analytics and news for stock and options traders of all levels.

COMPANY HIGHLIGHTS

- BLBX’s web-based software employs "predictive technology" enhanced by artificial intelligence (AI) to find volatility and unusual market activity that may result in the rapid change in the price of a stock or option.

- Blackbox continuously scans the NASDAQ, New York Stock Exchange, CBOE, and all other options markets, analyzing over 8,000 stocks and over 1,000,000 options contracts multiple times per second.

- They provide their users with a fully interactive social media platform that is integrated into their dashboard, enabling their users to exchange information and ideas quickly and efficiently through a common network. The company recently introduced a live audio/video feature that allows our members to broadcast on their own channels to share trade strategies and market insight within the Blackbox community.

- Blackbox is a SaaS company with a growing base of users that spans 42 countries; current subscription fees are $99.97 per month or $959.00 annually.

Blackbox is here to level the playing field offering users technology that has too often been reserved for large financial firms, hedge funds, and the Wall Street elite.

THE SYSTEM

THE MOST USER FRIENDLY STOCK & OPTIONS TOOL ON THE MARKET

FEATURING REAL-TIME EDUCATION IN A COMMUNITY OF TOP TRADERS!

BLACKBOX FINDS THE ACTION!

Blackbox is distinctly different than any other trading system on the market. The company’s system automatically posts symbols alerting users to explosive opportunities in the market in real time.

HOW IT WORKS

Long before the market opens, Blackbox’s trading system uses proprietary algorithms that alert the user to the most active stocks and options. Once an alert is posted, users can click on the symbol and find out why the stock received an alert. Use their live charting tool and proprietary volatility indicator to see which stocks are breaking out and posting the biggest gains.

A POWERFUL ADVANTAGE

Their system continuously scans the NASDAQ, New York Stock Exchange, CBOE and all other options markets analyzing over 8,000 stocks, and up to 900,000 options contracts multiple times per second. Their algorithms are similar to those used in extremely profitable ‘high frequency trading’ (HFT) strategies.

OPTIONS FLOW

The company’s intelligent options flow uses advanced logic to show their members what's really moving the market. The data is so fast that they can see the transaction while the person's order is being filled. Before it even hits their account, they see the transaction. That is the power of BlackBoxStocks options flow! When trading options, you want to follow the smart money. For options traders, this information is gold!

DARK POOL

BlackBox doesn't just monitor dark pool transactions, they drag them out of the shadows and parade them in real-time for our members advantage. Big money has many resources at their disposal for trading stocks and now, with BlackBox, the playing field is level. Their members can see dark pool transactions and position their own trades accordingly before the market has time to react.

OPTIONS ALERTS

BlackBox is powered by high-speed servers, monitoring over 13,000 stocks and options at the same time, analyzing each tick multiple times per second. Their options algorithms are like those used in extremely profitable high frequency trading strategies. Yet, they have categorized our alerts in a way that makes them easy to follow regardless of experience or trading style.

EDUCATION

Blackbox is unique and revolutionary in the fact that they help their users remain educated on investing and trading!

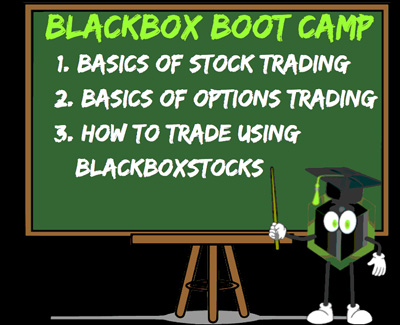

They offer their members a variety of free classes starting with BlackBox Bootcamp.

This 3 hour live webinar is for their members that are new to trading. BlackBox Bootcamp is offered twice weekly and covers the basics of trading stocks, options, as well as how to use the features of their platform.

Hour 1 - How to Trade Stocks

- Basic market terminology

- Trading – buying and selling

- What is “short selling” and what are the risks?

- Pattern Day Trader (PDT) rules – What are they and how do they impact your trading?

- Recommended brokerages – TD Ameritrade discounted commissions and brokers to avoid

- The dangers of trading Penny Stocks and Low Float Stocks

- An Introduction to Technical Analysis - charts, candles, and more

- Identifying support and resistance levels

- FIVE ways people blow up their accounts! (How to protect your capital and profits)

- Tips for new traders

Hour 2 – How to Trade Options

- Options terminology

- What are calls and puts?

- Directional option strategies

- Reading an options chain

- Choosing a strike and expiration

- Settlement timeframes

- Cash account option for small accounts

Hour 3 – Tutorial on the Blackbox System

This segment will give an in-depth look at the BlackBox system and how to use its powerful features including:

- Their multiple alert types and what they mean:

- Pre-Market Alert

- Volume Active Alert

- Price Spike Alert

- Retracement Alert

- Rapid Decline Alert

- Usual Suspect Alert

- The proprietary scanners and data tables plus their extensive charting program:

- Alert Log, Top 10 Gainers, Pre-market scannerIntraday scanner, Post market scanner, Volume ratio scanner, Alert charts, Volatility indicator (our substitute for a Level 2 system), Charting tools, studies, and indicators

- Robust media features:

- Real-time news, Symbol specific news, Social media sentiment, Our dynamic BlackBox trading community, How to access our live trading rooms, Your moderators, How to connect, interact, and contribute – we encourage participation! Room guidelines. How to sign up for our private Twitter feed and other valuable content on BlackBox’s social media sites

They also offer advanced classes and continuing education free of charge for their members.

COMMUNITY

Within the Blackbox community, users can:

- Watch top traders LIVE channels for trading ideas and strategies.

- Use their fully integrated social media features to follow, direct message, or subscribe to other members!

- Follow trending stocks and other members within in the community.

- Post your trade confirmations and other useful content to engage with the community.

Recent Milestones:

- Blackbox recently announced they have achieved a significant milestone when they crossed the threshold of 6,000 active paid subscribers. In addition, Blackbox projects record high revenue for the fourth quarter ending December 31, 2021 ranging between $1.51 million and $1.56 million, an increase of 45% - 50% when compared to revenue of $1.04 million for the same period in 2020, resulting in record annual revenue for 2021.

- Blackboxstocks recently announced that the Company’s Board of Directors has approved a stock repurchase program for up to $2.5 million of the Company’s common stock. The repurchase plan will expire on December 31, 2022. The repurchase program will be executed consistent with the Company’s capital allocation strategy, which will continue to prioritize aggressive investments to grow the business.

In November of 2021, the company announced the closing of its underwritten public offering of 2,400,000 shares of common stock on November 15, 2021 that was priced to the public at $5.00 per share. The Company received aggregate gross proceeds of $12 million, before deducting underwriting discounts, commissions, and other estimated offering expenses.

Fintech in the News

Social Media Influencing Investment Decisions at Global Institutions

What is FinTech? “Democratization of financial services” and ”Technology Supremacy”

The Company Team

Gust Kepler

CEO Co-Founder

Gust Kepler serves as the Chief Executive Officer for BlackBoxStocks, Inc. Mr. Kepler is a firm believer in the adage "simplicity sells". His mission as the founder and developer of the company's technology is to offer the general public a comprehensive financial technology tool in a simple and user-friendly format. In addition to overseeing all aspects of product development, Kepler is responsible for strategic planning, marketing and corporate financial decisions.Mr. Kepler previously served as the President of G2 International, Inc. G2 is a consulting firm with expertise in investment banking founded by Mr. Kepler in 2002. G2's primary focus is taking private companies public and providing advice with regard to capitalization, strategic planning, and investor relations.Prior to founding G2, Mr. Kepler founded Parallax Entertainment, Inc. in 1996. Parallax was an independent record label, online promotional vehicle and e-commerce solution for musicians. Prior to Parallax, Kepler was the founder and President of Glance Toys, a toy and junior sporting goods company. Over its 10-year span, Glance sold its brand of products in dozens of major retail chains including Wal-Mart, Target, The Sports Authority and 7-Eleven.

Eric Pharis

Co-Founder Director of Operations

Eric Pharis has been working in quantitative finance for 20 years. Pharis earned his bachelor of in Mechanical Engineering from The University of Texas Austin in 1998 and his Masters Degree in Operations Research from Cornell University with a certificate in Financial Engineering in 1999. While studying at UT, Pharis also worked for IBM and developed financial models to assist in output optimization.

After graduating Cornell, Pharis moved to Wall Street and began proprietary trading at Daytek Securities, the founders of Island ECN, a pioneer in the area of electronic and algo trading.

In 2004, Pharis joined forces with David Kyle and founded Karma Blackbox LLC (not affiliated with BlackBoxStocks, Inc.). This company focused on developing algorithms for high frequency trading. In 2005, Pharis and Kyle launched their first algo and it was profitable every month thereafter, generating only 15 days of net trading losses in its first 650 days of trading. The duo subsequently expanded their automated trading operations to exchanges in London, Tokyo, and the commodities markets.

In 2012, Pharis and Kyle launched QuantBrasil – a fully quantitative, computer driven hedge fund in Brazil. This fund was built using the proprietary logic from their previous trading platforms, and was headquartered in Miami and Rio de Janeiro.

Pharis is in charge of developing and implementing all tools and features for the market analytics on the Blackbox platform. He also manages all historical data and acts as the lead data analyst for BBS.

David Kyle

Co-Founder

David Kyle has been working in software development for 21 years. Kyle earned his Bachelor of Science in Electrical Engineering from the University of Texas at Austin in 1996. While at UT, Kyle worked for Microsoft supporting the launch of Windows 95.

After graduating from the University of Texas in 1996, Kyle returned to Dallas and began working in quality assurance and support at J. Driscoll & Associates, who specialized in account reconciliation software for retailers. Kyle left Driscoll to develop software for Globeset from 2000. In 2002 he advanced to Trintech as a Senior Software Developer.

In 2004, Kyle joined forces with Eric Pharis and founded Karma Blackbox LLC (not affiliated with BlackBoxStocks, Inc.). This company focused on developing algorithms for high frequency trading. In 2005, Kyle and Pharis launched their first algo and it was profitable every month thereafter, generating only 15 days of net trading losses in its first 650 days of trading. The duo subsequently expanded their automated trading operations to exchanges in London, Tokyo, and the commodities markets.

In 2012, Pharis and Kyle launched QuantBrasil – a fully quantitative, computer driven hedge fund in Brazil. This fund is built on the Karma Blackbox trading platform and has headquarters in Miami and Rio de Janeiro. Kyle is in charge of software engineering, database management, tick feed processing and all aspects of system development for the BlackBoxStocks platform.

Robert Winspear

Chief Financial Officer

Mr. Winspear was appointed as a Director and our Chief Financial Officer and Secretary on September 11, 2021. Prior to joining the Company, Mr. Winspear had been the President of Winspear Investments LLC, a Dallas based private investment firm specializing in lower middle market transactions, since 2002.

Winspear Investments has made investments in a wide range of industries including banking, real estate, distribution, supply chain management, mega yacht marinas and hedge funds. Mr. Winspear was Vice President, Secretary and Chief Financial Officer of Excel Corporation, a credit card processing company (formerly EXCC:OTC) from May of 2014 to June of 2017. Mr. Winspear is on the board of directors of Alpha Financial Technologies/EAM Corporation, located in Dallas, Texas and VII Peaks Co-Optivist Income BDC II, Inc. an investment management company located in Orinda, California. Mr. Winspear earned a BBA and a MPA from the University of Texas at Austin.

Brandon Smith

Chief Technology Officer

Brandon Smith serves as the Acting Chief Technology Officer for the company through his consulting firm Cyfeon Solutions. Brandon serves as the lead architect and developer for BlackBoxStocks real-time web application.

Cyfeon is a Financial Services vertical focused on operational and regulatory compliance. Financial Institutions such as Schwab, HSBC, Cowen, and more use Cyfeon's purpose built solutions to federate and analyze large and disparate sources of data.

Prior to co-founding Cyfeon, Brandon managed the Telecom & Network Outsourcing vertical for S3. His responsibilities included business development and delivery oversight of companies such as British Telecom, Hewlett Packard, and Proctor and Gamble.

Prior to S3, he managed Lavastorm's Professional Services unit. He was responsible for managing a team of 50 full time employees worldwide as well as ensuring the delivery of enterprise grade solutions to those global customers.

Brandon holds an MBA from Southern Methodist University, a BBA in CIS from Texas State University and served four years in the United States Marine Corps.

The Bottom Line

Headquartered in Dallas, TX, Blackboxstocks, Inc. (NASDAQ: BLBX) is dedicated to being the most user-friendly stock and options tool on the market!

This rising FINTECH player needs to be high on your radar as it markets its innovative platform to an enormous crowd!

Easier and newer ways of trading are becoming much more desired as the younger generations’ interest in trading grows.

With proper education and tools that new investors need, trading and investment can be made simple and accessible for everyone.

BLBX offers real-time education for its users in a community of some of the TOP traders!

Their system automatically posts symbols alerting users to explosive opportunities in the market in real time.

Blackbox is here to level the playing field offering users technology that has too often been reserved for large financial firms, hedge funds, and the Wall Street elite.

This emerging company is distinctly different than any other trading system on the market. The company’s system automatically posts symbols alerting users to explosive opportunities in the market in real time.

The global financial technology market is expected to grow at a high rate as more and more everyday individuals and youth begin their investment journey….

With their innovative social media platform geared towards all-experience levels of traders, this may be one of the most exciting fintech companies around right now!

The potential for BLBX is SKY-HIGH!!!

This website is wholly owned by tradigital marketing group, inc. (d/b/a “tradigital ir”). Our reports are advertorials and are for general information purposes only. never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our email list, as well as any social networking platforms we may use. please note well: tradigital ir and its employees are not registered investment advisors, broker-dealers, or member(s) of any association for other research providers in any jurisdiction whatsoever. release of liability: through use of this website, viewing or using you agree to hold tradigital ir, its operators, owners, and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. tradigital ir encourages readers and investors to supplement the information in these reports with independent research and other professional advice. all information on featured companies is provided by the companies profiled or is available from public sources and tradigital ir makes no representations, warranties, or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. none of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. instead, tradigital ir strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. tradigital ir’s full disclosure is to be read and fully understood before using tradigital ir's website, or joining tradigital ir's email or text list. From time to time, tradigital ir will disseminate information about a company via website, email, sms, and other points of media. By viewing tradigital ir's website and/or reading tradigital ir's email or text newsletter you are agreeing ----> https://tradigitalir.com/disclaimer-tmg/. all potential percentage gains discussed in any communications are based on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising companies for monetary compensation. in compliance with section 17(b) of the securities act we are disclosing that we have been compensated a fee pursuant to an agreement between tradigital and blackboxstocks inc. tradigital was hired for a period beginning november 2021 and ending february 2022 to publicly disseminate information about blackboxstocks inc. via website, email, and sms. We were paid two hundred thirty thousand usd via ach. we own seventy-five thousand restricted common shares of blackboxstocks inc., which are eligible for sale on 05/30/2022. For the purpose of this disclaimer, we suggest that you assume we will sell all of our shares once the restriction is lifted on 05/30/2022. Readers are advised to review sec periodic reports: forms 10-q, 10k, form 8-k, insider reports, forms 3, 4, 5 schedule 13d. tradigital ir is compliant with the can-spam act of 2003. tradigital ir does not offer investment advice or analysis, and tradigital ir further urges you to consult your own independent tax, business, financial, and investment advisors. investing in micro-cap, small-cap, and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled.The private securities litigation reform act of 1995 provides investors a safe harbor in regard to forward-looking statements. any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or performance are not statements of historical fact may be forward-looking statements. forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. understand there is no guarantee past performance will be indicative of future results in preparing this publication, tradigital ir has relied upon information supplied by its clients, as well as its clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can not be guaranteed. investors should not rely on the information contained on this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, tradigital ir and its owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. tradigital ir is not responsible for any claims made by the companies advertised herein, nor is tradigital ir responsible for any other promotional firm, its program, or its structure. tradigital ir is not affiliated with any exchange, electronic quotation system, the securities exchange commission, or finra.