This Diversified Holding Company’s Business Plan Includes Distributing Spinoff Stock Dividends to DSS Inc. Shareholders

Introducing DSS, Inc. (NYSE American: DSS), a multi-national and diverse portfolio company that now operates 8 business lines with over 40 subsidiaries.

Companies like Johnson & Johnson, General Electric Company, and 3M Co. have been making headlines due to lucrative recent spinoffs to shareholders.

This spinoff strategy makes DSS, Inc. an exciting and unique opportunity for investors. The company currently has three (3) potential IPO spin-offs planned for 2023, which could provide investors with pure-play stock tickers just by owning shares of DSS.

Download Research Report

DSS, Inc. (NYSE American: DSS) operates through 8 divisions and 40 subsidiaries in diversified market sectors including biotechnology, commercial banking, packaging and real estate… with plans to spinoff 3 separate companies to shareholders in the form of stock.

Headquartered in New York, DSS, Inc. has developed strong market positions in product packaging, biotechnology, direct marketing, commercial lending, securities and investment management, alternative trading, digital transformation, secure living, and alternative energy.

DSS’s main source of revenue has primarily come from their printing and packaging subsidiary, Premier Packaging. They are expected to increase production capacity and benefit from higher pass through costs and increasing market share.

Product Packaging has become an integral part of the business as packaging has become an extension of a company’s brand for online retailers. Product authentication and engaging customers through design helps businesses build relationships with clients which drives higher sales.

The Product Packaging market is projected to surpass $1.3 trillion by 2028.

DSS, Inc. (NYSE American: DSS) operates in attractive markets — making this company an exciting growth story to keep your eye on for corporate developments.

DSS, Inc. has been transformed into a unique, multi-industry business growing through opportunistic acquisitions. Significantly for any investor, the company’s enterprise value is approximately $62 million, and 2023 revenues are projected at $63 million while the market cap is a modest $29 million.

DSS, Inc. recently acquired a development-stage biotech company, Impact Biomedical, which is expected to have the first portion of its spin-off to shareholders by the end of the Second Quarter, 2023.

This first of three planned spin offs could prove to have great incremental value for shareholders depending on the progress of the IPO.

The biotechnology market is expected to be worth around $3.44 trillion by 2030.

DSS, Inc. (NYSE American: DSS) empowers companies to create value and enable shareholder value enhancement spurred by innovation, industry needs and asset acquisitions.

Investment Highlights:

- DSS, Inc. currently operates 8 business lines with over 40 subsidiaries making the company a diverse, multi-industry business with massive market potential.

- The markets the company operates in have unlimited potential and the opportunities within multiple high-growth markets are endless, predominantly because entities within these sectors are contemporary, scalable, and offer recurring revenue streams.

- Recently, companies like Johnson & Johnson, General Electric Company, and 3M Co. have been making headlines due to the successful spin offs to shareholders. This spinoff strategy makes DSS, Inc an exciting and unique opportunity for investors, as the company currently has three (3) potential IPO spin-offs on the table for 2023, which could provide investors with pure-play tickers just by owning shares of DSS.

- Planned Spinoff #1 –DSS bought a development-stage biotech company, Impact BioMedical, that is expected to complete the initial step of its spin-off to shareholders in the first half of this year. This development could produce exciting incremental value for shareholders depending on its IPO results.

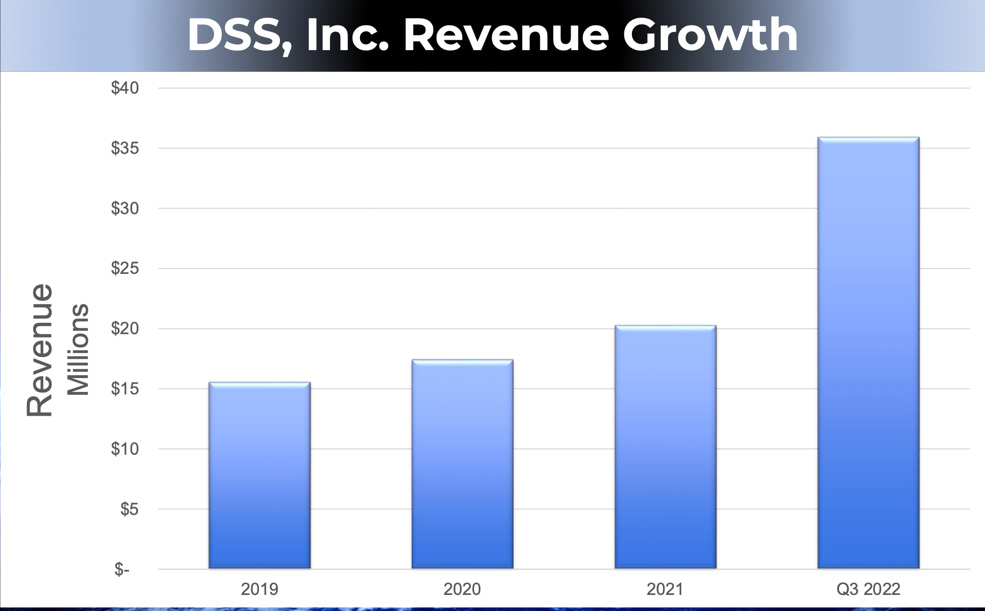

- DSS has experienced exciting growth, with $264 Million in total assets and revenue growth of 172%.

- The company’s enterprise value is approximately $62 million and 2023 revenues are projected at $63 million.

- Planned Spinoff #2– After it builds its REIT to a size of over $200 million in assets, DSS, Inc. plans to also spin off that entity to shareholders.

- Planned Spinoff #3 – DSS, Inc. owns AmericanPacific Bancorp, a bank that makes commercial loans and is expected to be spun off to shareholders in the near future. This bank has funded the building purchases of the company’s REIT. If DSS retains 50% of this bank after the spin-off, this business alone could be worth more than the entire DSS enterprise value!

DSS, Inc. (NYSE American: DSS) strategically acquires and develops assets to enrich the value of its shareholders through periodic calculated IPO spinoffs.

Market Potential

- Product Packaging is projected to surpass $1.3 trillion by 2028.

- Biotechnology market is expected to be worth around $3.44 trillion by 2030.

- Direct Marketing is a global business generating approximately $180 billion and is projected to have its fifth year of double-digit growth spurred by the new Gig Economy.

- Commercial Lending growth is at a 14-Year High in 2022, and market size valued at over $8 billion in 2020, is projected to reach almost $30 billion by 2030.

- Securities is a high-growth sector of $70 trillion and REITs earnings increased 24.6% this past year.

DSS, Inc. (NYSE American: DSS) has nearly unlimited market potential as it taps into high revenue growth markets making this an exciting and unique opportunity for investors.

About the Company:

DSS, Inc. is a multinational, public corporation operating a diversified portfolio of companies.

The company’s business lines include direct-to-consumer products, bio health, securities and funds management, blockchain and fintech, and renewable energy. Spurred by innovation, industry needs, and acquisitions, DSS, Inc is focused on and ready to empower companies of any and all sizes.

Its business model is based on an equity distribution system in which shareholders will receive shares in its subsidiaries as DSS strategically spins them out into IPOs. DSS’s historic business revolves around counterfeit deterrent and authentication technologies, smart packaging, and consumer product engagement.

Key Areas for Growth:

- Buying Assets: Securing investment vehicles and infrastructure to be able to generate revenue.

- Business Optimization: Identifying the business needs and empowering those businesses to be successful.

- Positive EBITDA: Achieving positive EBITDA by creating size, efficiency, and revenue generation within those businesses.

- Public Offering: Sharing the success with existing and new shareholders through a periodic spinoff strategy

DSS, Inc. Business Lines:

With 8 business lines and over 40 subsidiaries, DSS has multiple, high-growth sectors.

- Product Packaging

- Biotechnology

- Direct Marketing

- Commercial Lending

- Securities and Investment Management

- Alternative Trading

- Digital Transformation

- Secure Living

- Alternative Energy

American Medical REIT (AMRE) –Planned future spinoff

- Acquired five (5) medical facilities, totaling approximately 360,000 sq. ft. of quality healthcare assets across the US and more than $90 million in assets.

- Generates average yields of approximately eight percent (8%), and we have a massive pipeline of opportunities to further grow AMRE in the quarters ahead – including an LOI for a property that could more than double its total assets.

Premier Packaging Corporation, Inc.

- Relocated operations to a new 105,000 sq. ft. facility, increasing production capacity and increased meeting customer demand.

- Invested in state-of-the-art manufacturing equipment, people, and processes to increase capacity, improve quality and delivery, resulting in nearly 50% year-over-year revenue growth for this segment in the most recently reported quarter.

Impact BioMedical – Planned future spinoff

- Launched early testing on new bioplastics and strengthened intellectual property protections.

- Secured licensing agreements for its LineBacker portfolio leading to production and distribution of its viral-fighting compound, Equivir.

AmericanPacific Bancorp, Inc. – Planned future spinoff

- Issued more than $40 million in new loans since the third quarter 2021 acquisition.

- Assembled a diversified portfolio of strong credit quality that is generating an average 11.1% return.

Frank D. Heuszel

Chief Executive Officer, Director Frank D. Heuszel, 65, has served as a member of DSS's Board of Directors since July 2018 during which time he served as chairman of the company's Audit Committee until April 2019. On April 17, 2019, Mr. Heuszel was appointed by the DSS Board of Directors as the Chief Executive Officer of DSS, Inc. (then known as Document Security Systems, Inc.) and its Interim Chief Financial Officer. In 2021, Mr. Heuszel assigned the Interim Chief Financial Officer to the current DSS, Inc. CFO. Heuszel has extensive expertise in a wide array of strategic, business, turnaround, and regulatory matters across several industries as a result of his executive management, educational, and operational experience. Prior to joining DSS, Mr. Heuszel had a very successful career in commercial banking and business turnaround management. For over 35 years, Heuszel served in many senior executive roles with major US and international banking organizations. As a banker Mr. Heuszel has served as General Counsel, Director of Special Assets, Credit Officer, Chief Financial Officer and Auditor. Mr. Heuszel has also operated a successful law practice which was focused on the regulation and operation of banks, management of bank litigation, corporate restructures, and merger and acquisitions. In addition to being an attorney and executive manager, Mr. Heuszel is a Certified Public Accountant (retired), and a Certified Internal Auditor. Mr. Heuszel is also a member of the Texas State Bar, the Houston Bar Association, Association of Corporate Counsel, Texas Society ofCertified Public Accountants, and the State Bar of Texas Bankruptcy Section.

Jason T. Grady

Chief Operating Officer, DSS, Inc. and President, Premier Packaging Corporation Jason T. Grady has served as Chief Operating Officer since July 2019. As Chief Operating Officer, Grady manages operations of 8 business lines and 25 subsidiaries, advising the direction of each of the company's newly formed subsidiaries, and the research and development of emerging market opportunities across diverse business operations. Grady joined DSS in July 2010 and previously served as Vice President of Sales and Marketing prior to becoming President, Premier Packaging Corporation in August 2018, a position he still holds. Before joining DSS, Grady served as Director, Business Development at Berlin Packaging and Vice President of Marketing at Parlec Inc. Grady earned a bachelor's degree and MBA from the Rochester Institute of Technology.

In Summary…

DSS, Inc. (NYSE American: DSS) is a multi-national and diverse portfolio company that now operates 8 business lines with over 40 subsidiaries.

The company currently has IPO three (3) spin-offs in the works for 2023 offering investors an exciting and unique investment return.

DSS, Inc. operates in markets with unlimited potential, leading to endless opportunities within multiple high-growth markets.

The company has transformed into a unique, multi-industry business growing through opportunistic acquisitions.

With a market capitalization of $29 million, DSS’s enterprise value is approximately $62 million and 2023 revenues are projected at $63 million, making the company an undervalued investment opportunity even before the first of the three planned spinoffs are completed.

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

SCD Media LLC (d/b/a “Smallcaps Daily”), hereinafter referred to as “Smallcaps Daily,” and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party”. The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation”.

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Smallcaps Daily, its managers, its employees, affiliates, and assigns (collectively the "Publisher") do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

Release of Liability: through use of this website, viewing or using you agree to hold Smallcaps Daily, its operators, owners, and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Smallcaps Daily encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the company profiled or is available from public sources and Smallcaps Daily makes no representations, warranties, or guarantees as to the accuracy or completeness of the disclosure by the profiled company. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Smallcaps Daily strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Smallcaps Daily’s full disclosure is to be read and fully understood before using Smallcaps Daily's website, or joining Smallcaps Daily's email or text list. From time to time, Smallcaps Daily will disseminate information about a company via website, email, sms, and other points of media. By viewing Smallcaps Daily's website and/or reading Smallcaps Daily's email or text newsletter you are agreeing to this ----> https://Smallcaps Daily.com/disclaimer/. All potential percentage gains discussed in any communications are based on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising companies for monetary compensation.

If you have questions or concerns about a product you’ve seen in one of our emails, emails, text newsletters or SMS, we encourage you to reach out to that company directly.

Disclaimer – Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated, and edited by the owner of Smallcaps Daily. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to Smallcaps Daily. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Companies with low prices per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website. We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares, we will list the information relevant to the stock and the number of shares here.

COMPENSATION

In compliance with section 17(b) of the Securities Act we are disclosing that we have been compensated a fee pursuant to an agreement between Smallcaps Daily and TraDigital Marketing Group, Inc. (d/b/a/ “TraDigital IR”) hereinafter referred to as TraDigital IR. Please see TraDigital IR’s disclosure page here. Smallcaps Daily was hired by TraDigital IR for a period beginning January 2023 and ending July 2023 to publicly disseminate information about DSS, Inc. via website, email, and sms. We were paid five thousand usd via ACH. Readers are advised to review SEC periodic reports: forms 10Q 10K, form 8K, insider reports, forms 3, 4, 5 schedule 13d. Smallcaps Daily is compliant with the CAN-SPAM Act of 2003. Smallcaps Daily does not offer investment advice or analysis, and Smallcaps Daily further urges you to consult your own independent tax, business, financial, and investment advisors. investing in micro-cap, small-cap, and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. The private securities litigation reform act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or performance are not statements of historical fact but may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results in preparing this publication. Smallcaps Daily has relied upon information supplied by its clients, as well as its clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can not be guaranteed. Investors should not rely on the information contained on this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, Smallcaps Daily and its owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Smallcaps Daily is not responsible for any claims made by the companies advertised herein, nor is Smallcaps Daily responsible for any other promotional firm, its program, or its structure. Smallcaps Daily is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission, or FINRA.

DSS, Inc. is a client of TraDigital IR, an investor relations and communications firm. Please see TraDigital’s disclosures at www.tradigitalir.com.

Copyright © 2022 Smallcaps Daily. All rights reserved.