This NYSE Company Just Reaffirmed Revenue Guidance Of $90 Million Dollars And Q3 YOY Gross Profit Increase Of 35%…

With $90 Million Revenue guidance a Market Cap of under $4MM and only 2.7 Million shares in the float 1847 Holdings (NYSE: EFSH) may be a smart choice to have on your radar.

Download Research Report

Despite a turbulent market EFSH has still been seeing record revenues and announcing a slew of positive developments!

HIGHLIGHTS:

- Total revenue was $18.8M for Q3 2023 compared to $14.5M in Q3 2022, a 29.8% year-over-year increase!

- Gross profit was $8.0M in Q3 2023 compared to $4.9M in Q3 2022, a 64.9% year-over-year increase!

- 1847 Cabinets expanded their relationship with one of the nation's leading home builders.

- The company completed refinancing and upsizing of $15 million revolving credit facility for its subsidiary, ICU Eyewear

- The company expanded its subsidiary, Wolo Manufacturing Corp, into India through a supply chain diversification program.

- The company restructured promissory notes to non-dilutive debt instruments.

Investment Thesis:

The problem. Capital market inefficiencies have left the founders and/or stakeholders of many small business enterprises or lower-middle market businesses with limited exit options despite the intrinsic value of their business.

Given this dynamic, 1847 Holdings (NYSE: EFSH) can consistently acquire businesses it views as "solid" for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure and systems of those businesses in order to improve operations.

The end result? These improvements may lead to a sale or IPO of an operating subsidiary at higher valuations than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to EFSH's ability to pay regular and special dividends to shareholders.

1847 Holdings (NYSE: EFSH) has acquired ICU, a leading designer of Over-the-Counter (OTC), non-prescription reading glasses, sunglasses, blue light-blocking eyewear, sun readers, and outdoor specialty sunglasses in February 2023. ICU was founded in 1956 and is headquartered in Hollister, California.

ICU is a recognized leader in reading eyewear and sunglasses, as well as select health and personal care items. ICU has 10 brands and a comprehensive and innovative product offering of over 3,000 SKUs across the reading glass, sunglass, and health & personal care segments.

ICU's customer base consists of a broad range of national, regional, and specialty retailers comprising over 7,500 retail locations. ICU is the only OTC eyewear supplier in the U.S. to have meaningful penetration in all significant retail channels including grocery, specialty, office supply, pharmacy, and outdoor sports stores.

Acquisition Highlights:

- Revenue in excess of $19M and $1.7M of adjusted EBTIDA in 2021.

- ICU has developed a highly profitable and sustainable business model, with solid financials, positive EBITDA, and a gross margin of approximately 40%.

- ICU has 10 brands and a comprehensive and innovative product offering of over 3,000 SKUs across the reading glass, sunglass, and health & personal care segments.

- ICU’s customer base consists of a broad range of national, regional, and specialty retailers comprising over 7,500 retail locations.

- The company’s eyewear line has earned the title of #1 provider of OTC eyewear at Target.

High Mountain: Specializes in all aspects of finished carpentry products and services, including doors, door frames, baseboards, crown molding, cabinetry, bathroom sinks and cabinets, bookcases, built-in closets, fireplace mantles, etc., working primarily with large homebuilders of single-family homes and commercial and multifamily developers.

Innovative Cabinets & Design: Specializes in custom cabinetry and countertops for a client base consisting of single-family homeowners, builders of multi-family homes, as well as commercial clients.

Kyle's Custom Wood Shop, Inc.: Headquartered in Boise, ID, the company believes strong housing demand in the region is driven by out-of-state immigration into Idaho. Current operations are focused primarily in the Boise area, providing opportunities to capitalize on high-growth adjacent regions. In addition to regional expansion, EFSH plans to expand capacity by increasing the network of builders, participating in new bids, and investing in facilities and labor resources. Product line expansion and broadening sales channels to include multifamily housing remodels, and DIY segments could further accelerate growth.

Financial Highlights:

- Revenues from the construction segment (incl. Kyle’s) increased by $21,830,922, or 523.6%, to $26,000,227 for the nine months ended September 30, 2022 from $4,169,305 for the nine months ended September 30, 2021.

- Cost of sales for the construction segment increased by $13,555,821, or 594.6%, to $15,835,830 for the nine months ended September 30, 2022 from $2,280,009 for the nine months ended September 30, 2021.

- Gross profit was $10,164,397 and $1,889,296 for the nine months ended September 30, 2022 and 2021, respectively.

WOLO Manufacturing Corp.: A leader in horn technology (electric, air, truck marine, electronic specialty, air & backup alarms) and vehicle emergency warning lights offering the highest quality and the largest selection for cars, trucks, and industrial equipment. Wolo has supplied innovative automotive products: horns, emergency warning lights, security, and lighting, to the automotive aftermarket for more than 45 years.

The company sells its products to big-box national retail chains, through specialty and industrial distributors, as well as online/mail order retailers and OEMs. With a stellar reputation for innovative design, its current product line consists of over 455 products, including 54 patented products, as well as over 90 exclusive trademarks.

Financial Highlights:

- Revenues from the automotive supplies segment increased by $833,742, or 20.9% to $5,114,755 for the nine months ended September 30th, 2022 from $4,231.013 for the nine months ended September 30th, 2021.

- Cost of sales for the automotive supplies segment increased by $369,368, or 13.9%, to $3,028,040 for the nine months ended September 30th, 2022 from $2,658.672 for the nine months ended September 30, 2021.

- Gross profit was $2,086,715 and $1,572,341 for the nine months ended September 30, 2022 and 2021, respectively.

Long-term goals:

- Making and growing regular distributions to its common shareholders

- Increase common shareholder value

- Continue to identify, perform due diligence on, negotiate, and consummate platform acquisitions of small businesses in attractive industries.

- Plan to limit the use of third-party acquisition leverage so its debt will not exceed the market value of the assets acquired and that its debt to EBITDA ratio will not exceed 1.25x to 1 for its operating subsidiaries.

- By limiting the leverage in this manner, it will avoid the imposition on stringent lender controls on its operations that would otherwise hamper growth and otherwise harm its business even during times when there are positive cash flows.

A Proven Track Record:

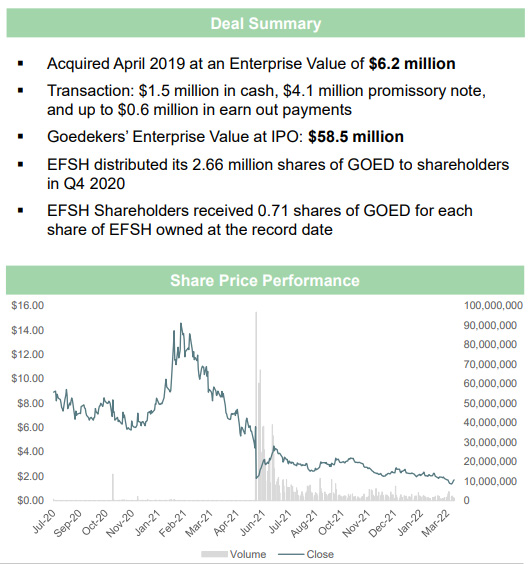

Former subsidiary Goedeker’s performance after IPO’ing prove EFSH's ability to unlock and create value.

Goedeker Inc. is an industry-leading e-commerce destination for appliances, furniture, and home goods.

An Experienced CEO:

The company was founded by CEO Ellery W. Roberts, a former partner of Parallel Investment Partners, Saunders Karp & Megrue, and Principal of Lazard Freres Strategic Realty Investors.

Ellery W. Roberts leading the reins has helped elevate EFSH to an NYSE listing and his expertise could soon lead the company to much greater heights!

- Mr. Roberts has 20+ years of private equity investing experience; directly involved in $3+ billion transactions.

- He formed RW Capital Partners LLC, an investment manager approved by the Investment Committee of the U.S. Small Business Administration in 2010 to raise and manage a Small Business Investment Company.

- He previously was a Managing Director of Parallel Investment Partners LP, responsible for ~$400 million in invested capital across two funds.

- He served as a Principal at Lazard Freres & Co. working in their Real Estate Principal Investment Area, where he was a senior team member involved in the investment of over $2.4 billion of capital.

- Mr. Roberts worked at Colony Capital, Inc., a $625 million private equity fund.

- He has experience as an Investment Banker in the Corporate Finance division of Smith Barne.

"I'm pleased to report revenues increased by 27.6% to $15.4 million and we achieved net income of $1.0 million for the first quarter of 2023. At the same time, our gross profit increased 35.0% over the same period last year. These results are further validation of the strength of our platform and our ability to acquire undervalued, cash flow positive, lower-middle market businesses at attractive valuations with minimum dilution to shareholders. Importantly, we are reaffirming our prior guidance of revenue in excess of $90 million in 2023.”

CEO Ellery W. Roberts

Vernice L. Howard - Chief Financial Officer

Ms. Howard has served as Chief Financial Officer since September 2021. She has over 30 years of experience in the fields of finance and accounting. Prior to joining us, she worked for Independent Electrical Contractors, Inc. and its affiliates for over eleven years as Chief Financial Officer, where she was responsible for providing leadership to the organization in the areas of finance, human resources and general facilities administration, in addition to setting policies, procedures, strategies, practices and overseeing the organization’s assets. The foundation of Ms. Howard’s accounting and finance experience began with public accounting for several years gaining experience in tax and auditing in the entertainment and nonprofit sectors as Chief Financial Officer for The Cronkite Ward Company, a television production company, and Director of Finance for Community Action Group (CAG), a nonprofit organization. Before her work with Independent Electrical Contractors, Inc., Ms. Howard’s professional background established an emphasis in forensic accounting. Ms. Howard is a Founding Member of Chief, which is a DC based vetted network of C-level or rising VP’s supporting and connecting exceptional women. Ms. Howard holds a Master of Business Administration in Finance from Trinity Washington University Graduate School of Business Management and Bachelor of Science in Accounting from Duquesne University.

Glyn C. Milburn - Vice President of Operations

Mr. Milburn joined 1847 in February 2023 after serving as a member of the company’s board of directors since August 2022. Mr. Milburn brings diverse operational and strategic expertise across multiple sectors, including commercial finance, labor negotiations, and operations management.

Before joining 1847, Mr. Milburn served as a Director at Ygrene Energy Fund, a consumer finance company based in California. Mr. Milburn also served as Partner at Jimmy Blackman & Associates, a full-service government and public affairs firm, where he was responsible for business strategy, client management, communications, and campaign management for a client portfolio comprised of large public safety labor unions, banking/finance companies, and hotel operators across the state of California. Mr. Milburn has also served as a special assistant in the City of Los Angeles, where he held two positions, one in the office of Los Angeles Mayor Eric Garcetti’s Office of Economic Development and another in the office of Los Angeles City Council. Previously, Mr. Milburn served as Executive Vice President of Texas AF2 Holdings, managing a portfolio of sports franchises handling their operations, compliance, and strategic planning.

Mr. Milburn co-founded Provident Investment Advisors LLC, a special investment vehicle for energy, technology, and healthcare ventures, where he served as a managing member. Mr. Milburn also serves on the board of directors ofPolished.comInc. Mr. Milburn holds a B.A. degree in Public Policy from Stanford University and an M.B.A. from the Kelley School of Business at Indiana University.

A Strategic Collaboration:

ICU Eyewear Holdings Inc. and Wolo Manufacturing Corp. have entered into a strategic collaboration to develop safety glasses for the automotive market.

According to Grand View Research, the global safety eyewear market size was valued at $3.74 billion in 2021 and is expected to record a compound annual growth rate (CAGR) of 4.4% from 2022 to 2030. North America accounted for the largest revenue share, 31.4%, of the global safety eyewear market in 2021.

"Our goal is to provide our customers with innovative products that protect them and keep them safe. ICU is a recognized leader in reading eyewear and sunglasses, as well as select health and personal care items such as personal protective equipment, making them the perfect partner for us. Additionally, ICU's customer base consists of a broad range of national, regional, and specialty retailers comprising over 7,500 retail locations. We look forward to working closely with ICU to develop a state-of-the-art safety eyewear brand for the automotive market."

Dan Brown, Chief Executive Officer of Wolo

Developing these safety glasses for the automotive market represents a new product category for ICU and the company expects to launch in the third quarter of 2023..

In Summary…

With a repeatable process that allows 1847 Holdings (NYSE: EFSH) the opportunity to sell subsidiaries at a profit, this holding company may soon be capturing major Wall Street attention as it sells at mere pennies a share.

The company has proven its strategy is successful with the case of Goedekers, a company it acquired for $6.2M which later on went to have an enterprise value at IPO of $58.5M!!

Led by a seasoned management team and a CEO who has directly been involved in $3B+ transactions, EFSH is showing the lucrative opportunity there is to cater to a niche category.

Small businesses are the backbone of the economy. According to the Small Business Administration, small companies generate 1.5 million jobs a year and account for 64% of new jobs in America. Small businesses also contribute 44% of the U.S. economic activity, so as the number of new businesses grows so does their economic contribution!

Little-known NYSE company 1847 Holdings (NYSE: EFSH) is creating value for its portfolio companies through an accretive, private equity style, holding company, business model.

With a mission to generate very attractive risk-adjusted returns for investors, EFSH should be at the top of your radar!

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

SCD Media LLC (d/b/a “Smallcaps Daily”), hereinafter referred to as “Smallcaps Daily,” and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party”. The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation”.

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Smallcaps Daily, its managers, its employees, affiliates, and assigns (collectively the "Publisher") do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

Release of Liability: through use of this website, viewing or using you agree to hold Smallcaps Daily, its operators, owners, and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Smallcaps Daily encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the company profiled or is available from public sources and Smallcaps Daily makes no representations, warranties, or guarantees as to the accuracy or completeness of the disclosure by the profiled company. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Smallcaps Daily strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Smallcaps Daily’s full disclosure is to be read and fully understood before using Smallcaps Daily's website, or joining Smallcaps Daily's email or text list. From time to time, Smallcaps Daily will disseminate information about a company via website, email, sms, and other points of media. By viewing Smallcaps Daily's website and/or reading Smallcaps Daily's email or text newsletter you are agreeing to this ----> https://Smallcaps Daily.com/disclaimer/. All potential percentage gains discussed in any communications are based on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising companies for monetary compensation.

If you have questions or concerns about a product you’ve seen in one of our emails, emails, text newsletters or SMS, we encourage you to reach out to that company directly.

Disclaimer – Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated, and edited by the owner of Smallcaps Daily. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to Smallcaps Daily. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Companies with low prices per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website. We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares, we will list the information relevant to the stock and the number of shares here.

COMPENSATION

In compliance with section 17(b) of the Securities Act Small Caps Daily is disclosing that we have been compensated a fee pursuant to an agreement between Smallcaps Daily and IA Media LLC (d/b/a/ “IA Media”) hereinafter referred to as IA Media. Small Caps Daily was hired by IA Media for a period beginning June 2023 and ending October 2023 to publicly disseminate information about 1847 Holdings LLC via website, email, and SMS. Small Caps Daily was paid up to twenty-five thousand usd via ACH. Subsequently, Small Caps Daily was hired by IA Media for a period beginning February 2024 and ending August 2024 to publicly disseminate information about 1847 Holdings LLC via website, email, and SMS. Small Caps Daily was paid up to one hundred thousand usd via ACH. Readers are advised to review SEC periodic reports: forms 10Q 10K, form 8K, insider reports, forms 3, 4, 5 schedule 13d. Smallcaps Daily is compliant with the CAN-SPAM Act of 2003. Smallcaps Daily does not offer investment advice or analysis, and Smallcaps Daily further urges you to consult your own independent tax, business, financial, and investment advisors. Investing in micro-cap, small-cap, and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. The private securities litigation reform act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or performance are not statements of historical fact but may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results in preparing this publication. Smallcaps Daily has relied upon information supplied by its clients, as well as its clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can not be guaranteed. Investors should not rely on the information contained on this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, Smallcaps Daily and its owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Smallcaps Daily is not responsible for any claims made by the companies advertised herein, nor is Smallcaps Daily responsible for any other promotional firm, its program, or its structure. Smallcaps Daily is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission, or FINRA.

Copyright © 2024 Smallcaps Daily. All rights reserved.