With an Anticipated Oil and Gas Boom in Africa, This Newly Nasdaq Listed Oil & Gas Exploration and Development Company May Emerge as a Significant Energy Producer….

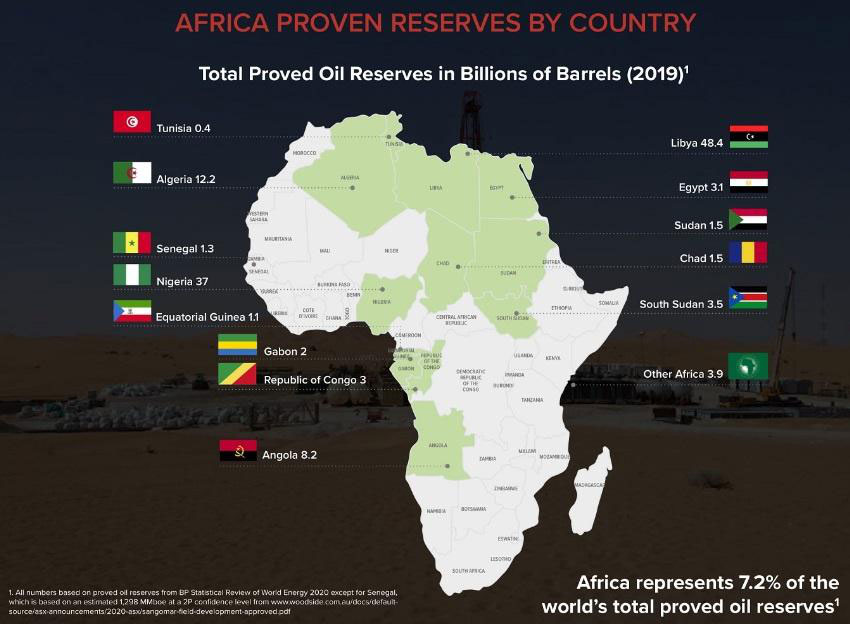

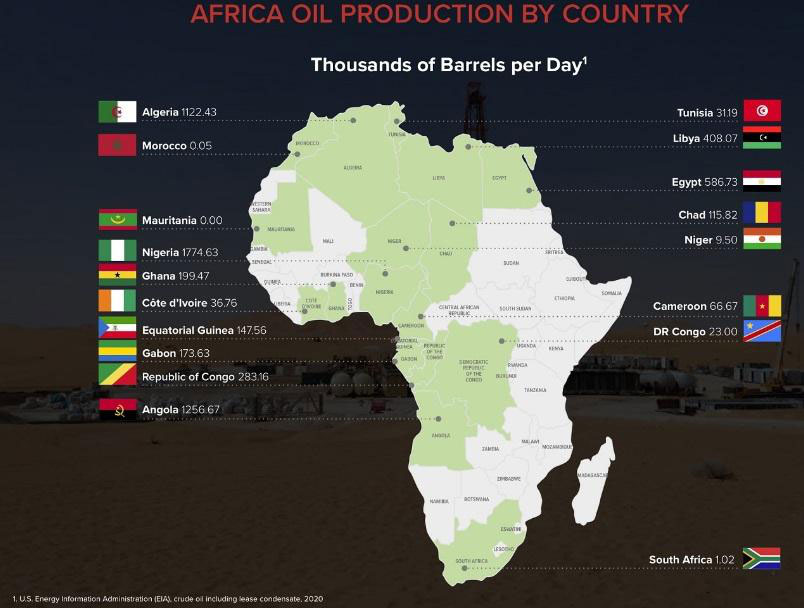

Many of the world’s largest oil producers are in the Middle East but did you know that Africa is home to FIVE of the top 30 oil-producing countries in the world?

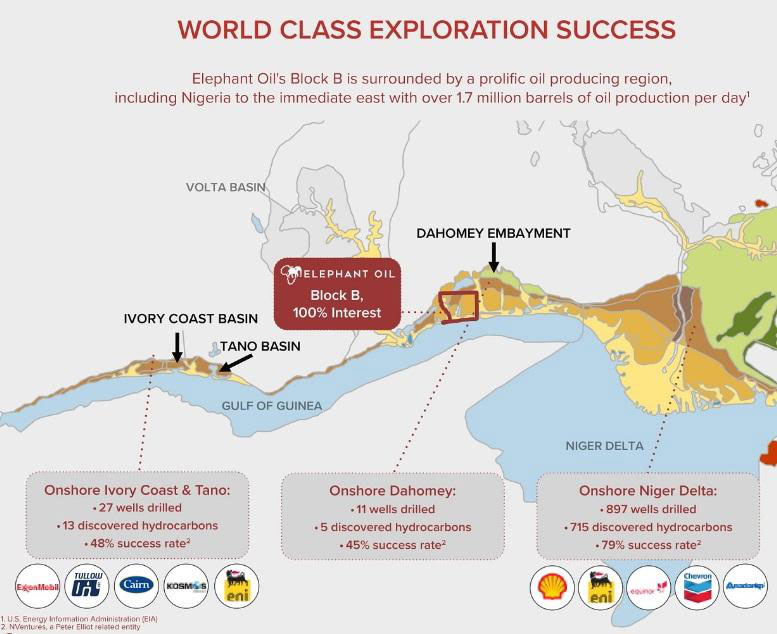

African oil is helping big names like Exxon Mobil, Chevron, Shell, and Eni accumulate massive revenues…..

With plenty of promising oil and gas opportunities on the continent, Texas-based Elephant Oil Corp. (NASDAQ: ELEP) is an oil and gas exploration and development company that is focused on under-explored areas in onshore Africa, where the reserve base is potentially large with a fraction of the drilling cost.

ELEP only recently made its public debut and may quickly attract considerable attention as it explores one of the lesser talked about oil and gas hotspots!

AND…. 60% of current shares are owned by management, founders, and board members!

Download Research Report

More Reasons to Have ELEP on Your Radar:

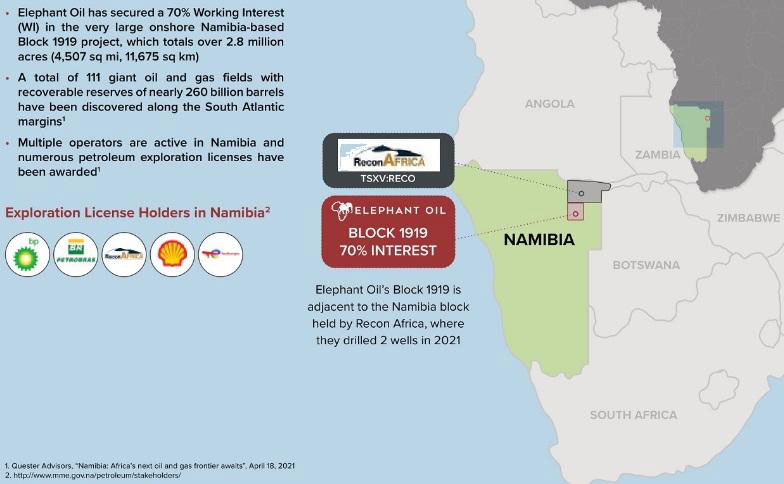

- The company has blocks with large targets: A 100% interest in onshore Benin Block B (1.1 million acres!!) and a 70% interest in onshore Namibia Block 1919 (over 2.8 million acres!!) This combined makes their acreage position LARGER than the state of Connecticut.

- Significant discoveries in the region. Neighboring countries host numerous hydrocarbon discoveries and fields while exhibiting high drilling success rates.

- For years, crude oil has been a major revenue driver for many African countries. Across the continent, crude deposits are abundant. A report by Statista said that the continent's proven crude oil reserves stood at 125.3 billion barrels in 2021 alone.

- The company’s Block B is surrounded by a prolific oil producing region, including Nigeria to the immediate east with over a staggering 1.7 million barrels of oil production PER DAY.

- Existing work helps de-risk the opportunity. Block 1919 Namibia has promising geology that is similar to tectono-stratigraphically to prolific hydrocarbon regions on both sides of the Atlantic. (Quester Advisors: “Namibia: Africa’s next oil and gas frontier awaits.” April 18, 2021)

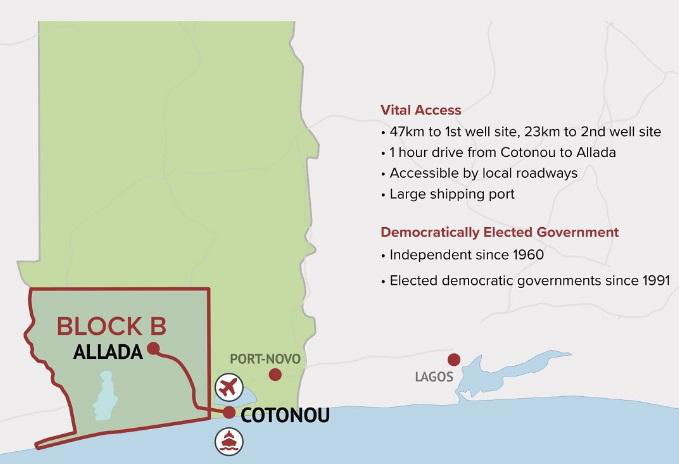

- Jurisdictions with well-established democracies. Benin gained independence from France in 1960 and has elected democratic governments since 1991.

- Africa is significant to oil and gas majors like Exxon Mobil, Chevron, Shell, and Eni. Eni has 60% of production from the continent.

- An experienced team of oil and gas veterans including CEO Matthew Lofgran who has over 15 years of international oil and gas experience and Dr. Stephen Staley, non-executive chairman, who has over 35 years of management and technical experience, including with Conoco Phillips (NYSE: COP) and BP (NYSE: BP). CFO Lanre Oloniniyi, with over 15 years of investment experience has also worked at BP.

- Crude oil ran up to a multiyear high of $120 a barrel in the Spring of 2022 and could rise higher as world oil demand is now forecast to average 101.3 mb/d in 2023.

Company Overview

Elephant Oil Corp. (NASDAQ: ELEP) is an independent oil and gas exploration stage company, led by an experienced management and technical team, which is focused on under-explored regions in Africa.

The company’s current asset portfolio includes an exploration license onshore in the Republic of Benin (“Benin”), as well as an exploration license onshore in the Republic of Namibia (“Namibia”). No wells have yet to be drilled and additionally, the company continues to review other potential assets for expansion.

Big Oil is Here to Stay

Oil prices have been rising for the better part of the past 12 months and accelerated sharply when Russia invaded Ukraine in February.

Many economists expect the price of oil to rise higher in the long term, especially if the war in Ukraine continues. Russia normally supplies roughly 10 percent of the oil consumed around the world. A stronger Chinese economy could also push prices higher.

Patrick De Haan, the head of petroleum analysis at Gas Buddy, tweeted that this year, Americans will see the highest Thanksgiving gas prices ever.

One of the biggest catalysts to spark a continued rally for oil prices has been OPEC recently agreeing to slash output.

The Organization of the Petroleum Exporting Countries (OPEC) agreed in October of 2022 that it would cut crude production by 2 million barrels a day, the largest reduction in output since the height of the pandemic in 2020!

Famed investor Warren Buffett is watched closely for his investment strategies. Buffett has consistently ranked highly on Forbes' list of billionaires, and he has a careful methodology for evaluating value stocks and investing.

Earlier this year Buffet’s Berkshire Hathaway had received permission to buy up to half of Occidental Petroleum (NYSE: OXY). The conglomerate has already increased its Occidental stake drastically this year.

A full takeover of Occidental could be Berkshire’s biggest ever and may cost more than $50B.

There must be a reason why Buffett is doubling down on fossil fuels, and that could be because he believes prices are heading much higher.

Oil is one of the most important raw materials we have and finding more of it has been a priority for decades.

Several African countries have been gradually boosting their oil and gas output over the last year, as demand for fossil fuels continues to rise.

While many countries in the West are curbing their fossil fuel operations, the African region is offering major oil firms the opportunity to develop new, low-carbon oil operations in largely untapped areas.

Africa’s oil and gas industry is entering a new era. As the world looks to accelerate its transition away from fossil fuels, the pressures on the continent’s oil and gas producing nations are mounting.

Republic of Benin

In October 2013, ELEP signed a Production Sharing Agreement with Benin (the “Production Sharing Agreement”) providing a 100% licensed interest under the Production Sharing Agreement in onshore Block B, which is over 1.1 million acres, or 1,772 square miles or 4,590 square kilometers and is accessible by local roadways in a low density tropical forest environment.

The Benin Hydrocarbons Corporation (“SOBEH”), now known as SNH-Benin, the national oil company of Benin, has an option to acquire a 10% interest upon commercial discovery.

Trilogy Resource Corporation had previously operated on Block B but ceased its operations and relinquished its title to the property in 1992. Elephant Oil began exploration on Block B in 2013, and has continued to explore Block B, including by: (i) procuring a Full Tensor Gravity (Aero Gravity Gradiometry) survey undertaken by Fugro Airborne Surveys Pty Ltd over the entire Block B, (ii) reprocessing existing onshore 2D seismic survey prepared by Trilogy Resource Corporation and integrating such data with new offshore 2D seismic data from SNH-Benin, (iii) procuring a Passive Seismic survey undertaken by GeoDynamics Worldwide, which has helped in Elephant Oil’s understanding of the structural fabric and basin setting and (iv) procuring an Environmental and Social Impact Assessment (ESIA), which was performed by RPS Energy Limited.

ELEP plans to mobilize a drilling rig to Benin in 2023 to commence exploration drilling and additional surveys on the block.

Republic of Namibia

In August 2021, ELEP signed a Petroleum Agreement with Namibia for onshore Block 1919 (the “Petroleum Agreement”), which includes a minimum exploration expenditure of $5,000,000. The $5,000,000 minimum exploration expenditure condition will be deemed satisfied if the minimum work obligations are properly executed using best oil field practices, regardless of the specified expenditure amount.

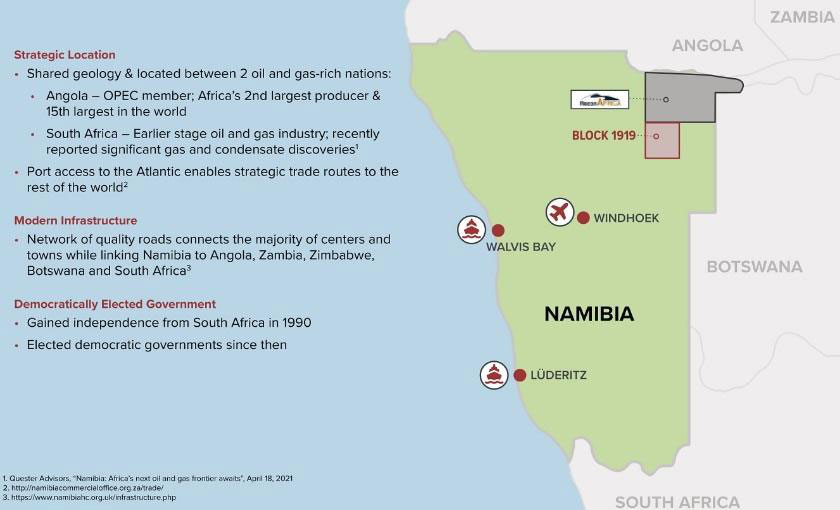

Elephant Oil holds a 70% working interest in Block 1919 on over 2.8 million acres, or 4,507 square miles, or 11,675 square kilometers, onshore and is accessible by local roadways in brushland environment. Niikela Exploration (PTY) LTD holds a 20% working interest and NAMCOR, a Namibian state-owned entity, holds the remaining 10% interest in the license on a carried interest basis.

The exploration period is 8 years and, unless extended, will terminate on August 22, 2029. In the event that an economically viable resource discovery is made at the licensed property, the Petroleum Agreement further entitles Elephant Oil to apply for and receive, subject to Namibian government approval, a production license of up to 25 years, renewable for a period of up to 10 years, from the Namibia Ministry of Mines and Energy (the “NMME”).

Namibia has geology that is similar tectono-stratigraphically to prolific hydrocarbon regions on both sides of the Atlantic, including the Santos and the Campos basins in Brazil, the Kwanza basin in Angola, the Congo basin to the north, the Colorado basin in Argentina and the South Pelotas basin in Uruguay.

According to “Quester Advisors: Africa’s next oil and gas frontier awaits (Featuring ReconAfrica)” by Jenny Xenos, MBA, CFA April 2021, as of the date of this prospectus, 26 exploration and appraisal wells have been drilled offshore in Namibia and 12 wells onshore, which may represent only a small portion of drilling density and available testing for hydrocarbon reserves.

In the short term, ELEP is immediately focused on onshore activities. Reconnaissance Energy Africa Ltd. (“ReconAfrica”) has announced onshore drilling in a block Namibia in April and June of 2021 and future drilling as well as seismic studies in the Kavango Basin.

According to a September 2021 study performed by Netherland Sewell & Associates, five potential oil and gas reservoir rock zones have been identified in the Kavango Basin!

ELEP has targeted a block adjacent to the south of ReconAfrica’s block in the Kavango Basin where the drilling and seismic studies have taken place and where it plans to conduct its onshore activities.

Company Strategy

Elephant Oil believes that they will be able to achieve their primary business objective of creating value for shareholders by executing on the following strategies:

- Moving forward on their exploration program, including mobilizing a drilling rig in 2023, followed by drilling two oil wells onshore in Benin, on what the company believes to be attractive identified leads in Block B.

- The company also plans to complete survey work in 2023 through 2025 to identify additional structures in Block B for future drilling.

- In Namibia, the company will begin exploration by performing surveys on shore, which we anticipate will lead to future drilling. Given the tremendous recent success from multiple operators in Namibia, the company may decide to increase their pace of exploration activity.

- The company is focused on the acquisition, exploration, appraisal and development of existing and new opportunities in Africa, including identifying, capturing and testing additional high-potential prospects to grow resources and develop reserves with the goal of generating net asset value and delivering returns to shareholders.

2023 Work Program

- Mobilize rig to Benin

- Drill 2 exploration wells on selected structures

- Acquire additional 2D seismic

- Optional further exploration opportunities

Environmental, Social Governance

Elephant Oil Corp. (NASDAQ: ELEP) actively engages with the local community and partners. The company strives to be a good member of the community, which may includes building schools and donating supplies, working with the university to provide experience in the industry and employing locals.

In Summary…

Steadily and quietly over the past decade, Africa has emerged as the world’s leading development area for oil and gas exploration.

“It’s quite an exceptional exploration record, really. There were 25 giant exploration discoveries over the past 10 years, more than anywhere else in the world. You can’t argue with that,” said Adam Pollard, senior research analyst in Edinburgh for Wood Mackenzie’s sub-Saharan Africa upstream team.

Oil and gas are essential to the global economy. According to the U.S. Energy Information Administration, the OPEC+ bloc's intention to drastically reduce oil supply to the market has halted oil supply growth for the rest of this year and into next, increasing market volatility and raising worries about energy security.

Oil prices could be headed a lot higher, making it a vital time to have your eyes on oil-related companies.

Elephant Oil Corp. (NASDAQ: ELEP) impressively has 60% of shares owned by insiders.

If ELEP can successfully develop its properties in under explored Benin and Namibia, it may benefit immensely from Africa’s large reserve base and provide meaningful growth opportunities for shareholders over the long-term!

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

SCD Media LLC (d/b/a “Smallcaps Daily”), hereinafter referred to as “Smallcaps Daily,” and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party”. The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation”.

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Smallcaps Daily, its managers, its employees, affiliates, and assigns (collectively the "Publisher") do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

Release of Liability: through use of this website, viewing or using you agree to hold Smallcaps Daily, its operators, owners, and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Smallcaps Daily encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the company profiled or is available from public sources and Smallcaps Daily makes no representations, warranties, or guarantees as to the accuracy or completeness of the disclosure by the profiled company. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Smallcaps Daily strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Smallcaps Daily’s full disclosure is to be read and fully understood before using Smallcaps Daily's website, or joining Smallcaps Daily's email or text list. From time to time, Smallcaps Daily will disseminate information about a company via website, email, sms, and other points of media. By viewing Smallcaps Daily's website and/or reading Smallcaps Daily's email or text newsletter you are agreeing to this ----> https://Smallcaps Daily.com/disclaimer/. All potential percentage gains discussed in any communications are based on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising companies for monetary compensation.

If you have questions or concerns about a product you’ve seen in one of our emails, emails, text newsletters or SMS, we encourage you to reach out to that company directly.

Disclaimer – Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated, and edited by the owner of Smallcaps Daily. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to Smallcaps Daily. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Companies with low prices per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website. We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares, we will list the information relevant to the stock and the number of shares here.

COMPENSATION

In compliance with section 17(b) of the Securities Act we are disclosing that we have been compensated a fee pursuant to an agreement between Smallcaps Daily and TraDigital Marketing Group, Inc. (d/b/a/ “TraDigital IR”) hereinafter referred to as TraDigital IR. Please see TraDigital IR’s disclosure page here. Smallcaps Daily was hired by TraDigital IR beginning March 2023 to publicly disseminate information about Elephant Oil Corp., via website, email, and SMS. We were paid five thousand USD via ACH. Readers are advised to review SEC periodic reports: forms 10Q 10K, form 8K, insider reports, forms 3, 4, 5 schedule 13d. Smallcaps Daily is compliant with the CAN-SPAM Act of 2003. Smallcaps Daily does not offer investment advice or analysis, and Smallcaps Daily further urges you to consult your own independent tax, business, financial, and investment advisors. investing in micro-cap, small-cap, and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. The private securities litigation reform act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or performance are not statements of historical fact but may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results in preparing this publication. Smallcaps Daily has relied upon information supplied by its clients, as well as its clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can not be guaranteed. Investors should not rely on the information contained on this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, Smallcaps Daily and its owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Smallcaps Daily is not responsible for any claims made by the companies advertised herein, nor is Smallcaps Daily responsible for any other promotional firm, its program, or its structure. Smallcaps Daily is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission, or FINRA.

Elephant Oil Corp. is a client of TraDigital IR, an investor relations and communications firm. Please see TraDigital’s disclosures at www.tradigitalir.com.

Copyright © 2022 Smallcaps Daily. All rights reserved.