Introducing FORME (NASDAQ: TRNR) A Premium Digital Smart Home Gym Innovator Introducing Virtual Personal Training Services Through its Award-Winning Connected Hardware Products with a Differentiated Business Model

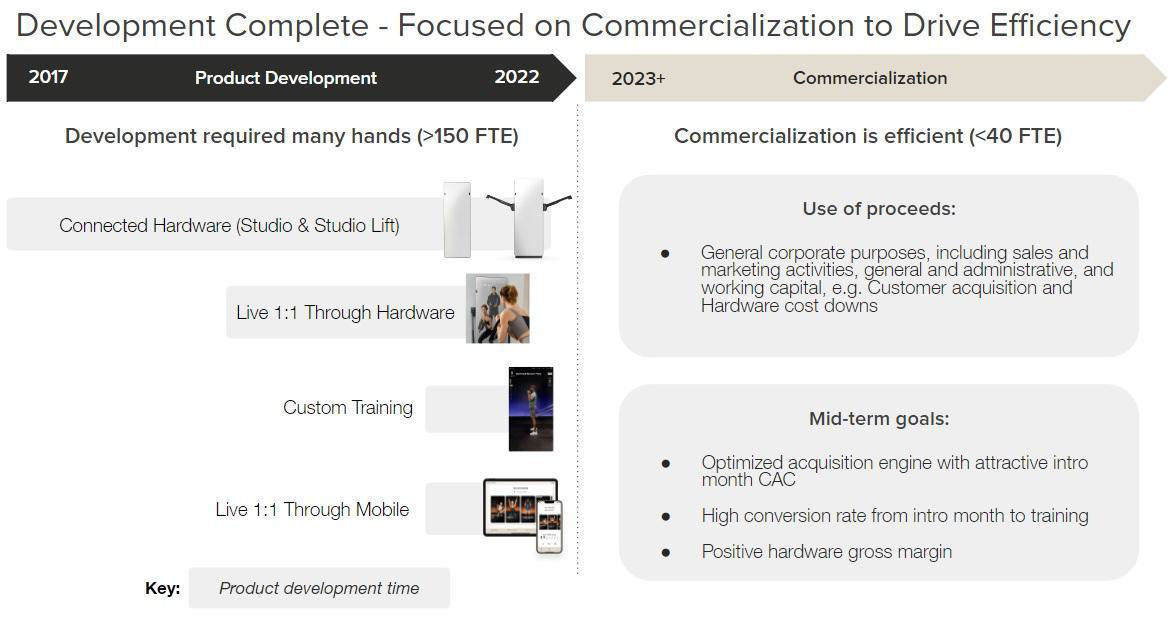

After completing product development with $100M+ from over 400 investors in its technology platform, FORME (NASDAQ: TRNR) is already commercializing and delivering against sales backlog of their products.

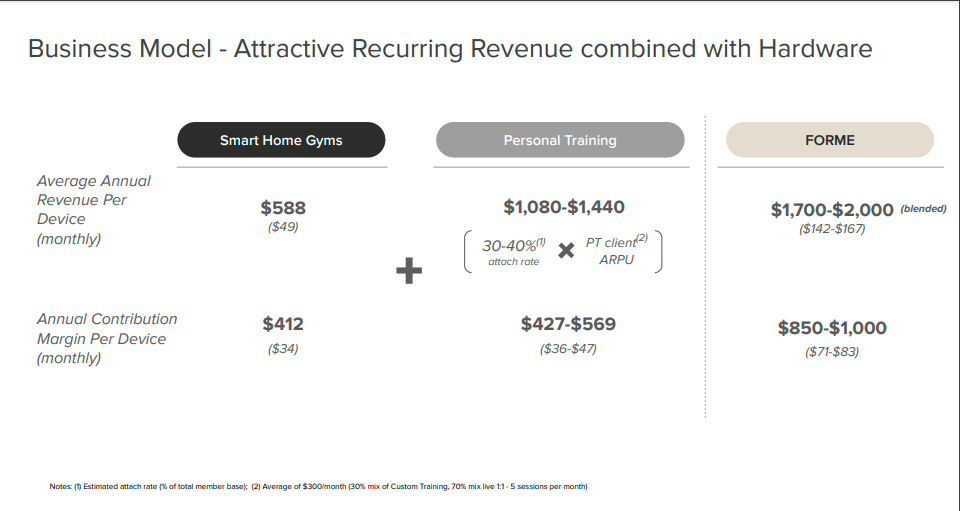

FORME (NASDAQ: TRNR) has an average annualized recurring revenue per household of $1,650 as per the Company's Q1 release, which is higher than the competitors by 3x and their cost base is lower, allowing the company to have a higher return on capital.

There is a big innovation push within the made for consumer fitness equipment market. The evolution of fitness machines has been taken to new heights by the tech sector and smart home gym connected hardware have been the latest rage.

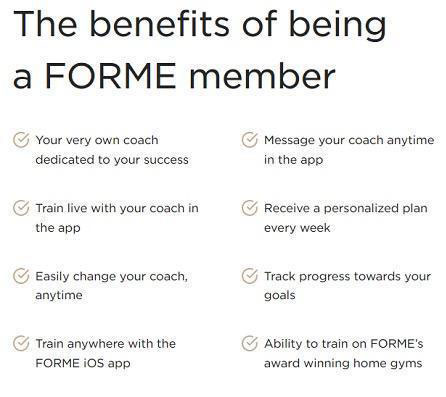

Imagine having the perfect gym and your own, real personal trainer (not AI) and if that gym wasn’t across town, but in your living room. FORME is offering just that and this emerging company is connecting consumers with personal trainers and introducing a new way to train from home.

The company has created an all-in-one smart home gym designed to connect people with real, elite coaches in all areas of fitness and wellness, including personal training and specialized sport instruction, nutrition, sleep, mindfulness, and injury rehabilitation.

FORME’s smart home gyms have been recognized by major fitness publications in 2023, such as Men’s Health, Shape, and Good Housekeeping as the best in at-home fitness.

The company recently went into mass production of its smart home gym products and is raising capital to fund commercialization and rapid growth.

Download Research Report

Peloton revolutionized the fitness industry by bringing the cardio gym to the home… newly traded FORME (NASDAQ: TRNR) is creating a brand-new health and fitness evolution!

Greetings Investors,

The U.S. health and fitness industry is booming and is showing no signs of slowing down anytime soon. Staying healthy and looking good will never go out of style and the pandemic forced more people to take their health routines at home. This evolution changed the at home fitness market considerably and created a market for FORME to thrive in.

This puts the spotlight on FORME (NASDAQ: TRNR), a newly public digital fitness company that combines award-winning smart home gyms with 1:1 personal training (from real humans).

The company has a goal to deliver an immersive experience and better outcomes for BOTH consumers and trainers.

The combination of stay-at-home exercise and socially distanced socializing has led to a “new normal” in health and fitness. The home-fitness equipment business grew by 170%, and fitness app downloads grew by 46% worldwide.

The Peloton (NASDAQ: PTON) brand (which has a 3.5B+ market cap) became a household name, and other similar products like the Mirror, Hydrow, and Tonal also entered the market, backed by celebrity endorsers.

There have always been proponents of at-home workouts, but the justification for many to avoid the gym is now more profound than ever since the pandemic. This will undeniably affect the popularity of gyms moving forward and emphasize the growing at-home workout arena.

This Has Created a Large Opportunity for FORME (NASDAQ: TRNR) to Become a New Household Name in the Multi-Billion-Dollar Fitness Space!

TOP REASONS TO HAVE NASDAQ:TRNR ON YOUR RADAR:

Through years of research and development, FORME has developed the smartest business model compared to its peers that is designed to generate high annual recurring revenue.

FORME began mass production of its smart home gyms at the end of 2022 and is already sold out.

The company’s current product portfolio, which consists of FORME Studio, FORME Studio Lift, and health coaching services, including a VOD membership, and Live 1:1 personal training, addresses a large consumer base.

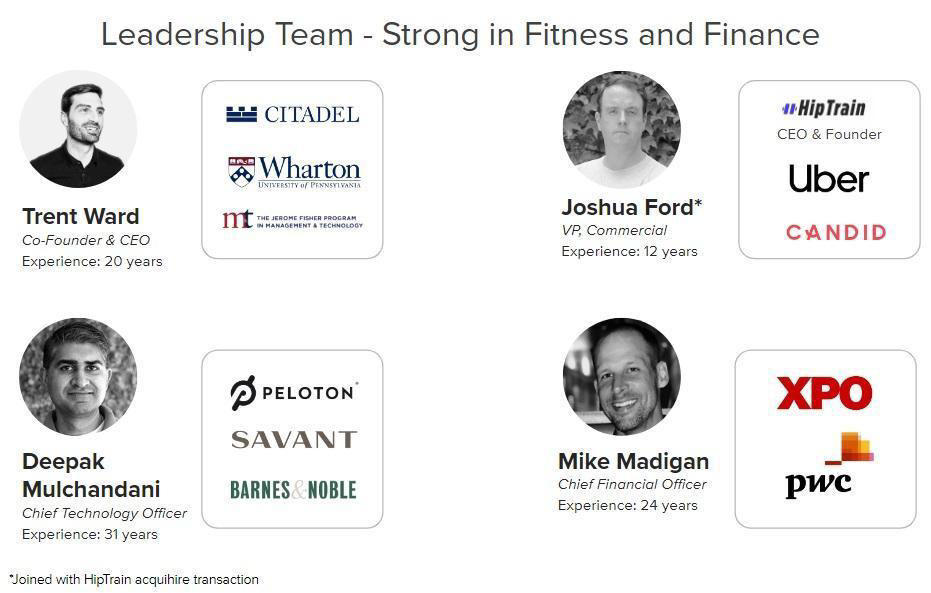

The Company’s management includes industry leaders who bring strength in finance and fitness: Trent Ward, Chief Executive Officer, who had a successful career in finance having worked at Citadel, Deepak Mulchandani, Chief Technology Officer, who was Head of Engineering at Peloton. Recent Insider Buying: Billionaire hedge fund manager Bradley James Wickens has made a series of purchases of shares adding to his investment in FORME: TRNR). Wickens, a UK-based hedge fund manager, started with a 10% ownership stake in FORME, and has since made a series of share purchases and increased his total number of TRNR shares by 150,000 during the month of May.

- European Expansion: FORME recently secured two European partnerships as the Company launches its expansion plan. FORME’s partnerships are with the luxury hotel chain Aethos and sports retail company SIGNA Sports United (NYSE: SSU). Aethos has hotels and clubs across Europe, while SIGNA is based in Germany and serves over 80 online sites. These partnerships will give FORME entry into a new market plus access to an established customer base.

FORME is differentiated as the only company to offer live 1:1 and asynchronous coaching memberships from the industry’s highest quality personal trainers.

According to the 2021 Global Wellness Institute, total global spending in the wellness industry in 2020 was $4.4 trillion, of which approximately $740 billion was spent on fitness and other categories of wellness, including yoga, barre, and Pilates.

Online/digital fitness, fitness apps, fitness equipment, and fitness tracker markets all experienced significant growth due to the pandemic.

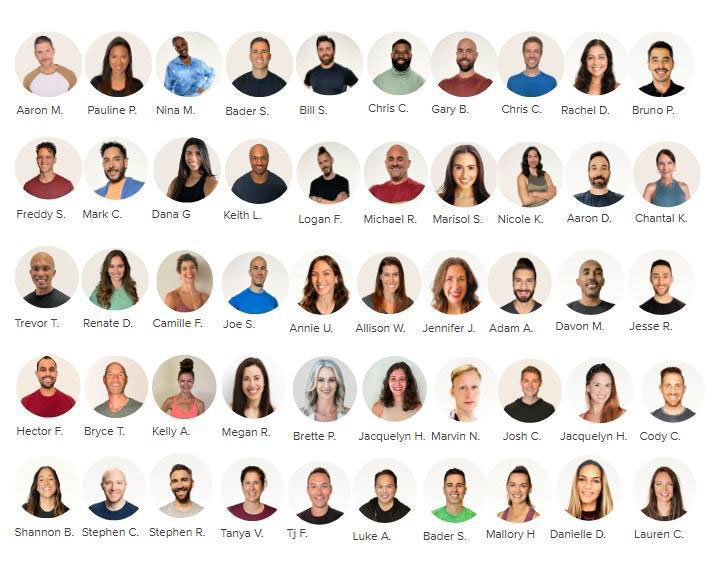

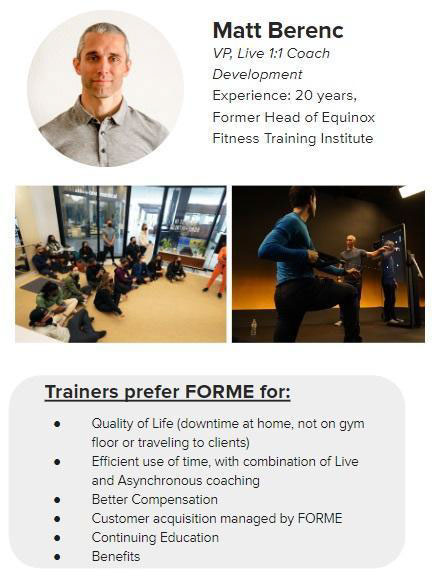

One of the best ways to protect, improve and transform your health is to work with an expert and FORME has hired a team of world-class trainers in the fitness and wellness industry.

FORME designed their product portfolio to be modular and customizable so that their product and service offerings can be tailored to a broad range of fitness goals, budgets, and needs, thereby accessing a larger addressable market.

- According to the company’s research, they believe their total addressable market includes nearly 10 million households, representing total potential revenue of $18 billion, all of which is in the United States.

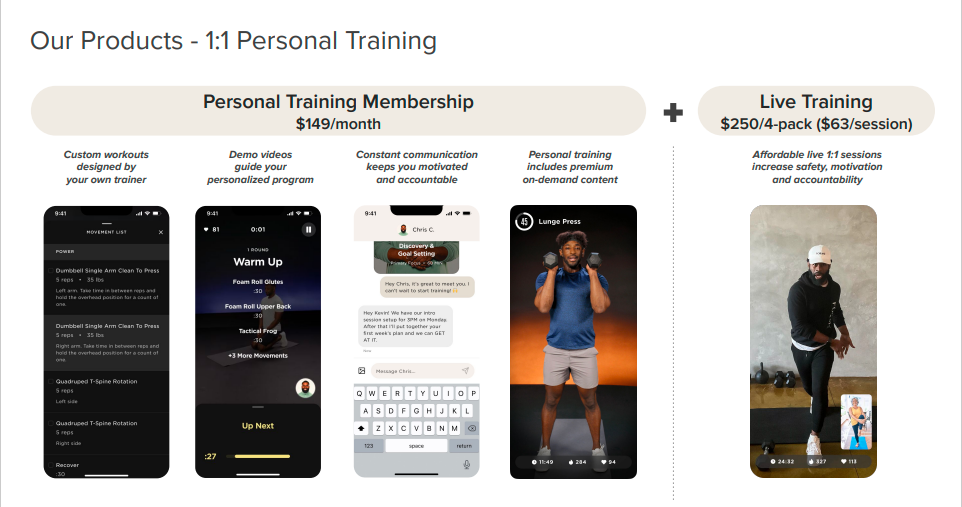

Company Overview

The company offers 1:1 Personal Training starting at $149/month + Live Sessions sold separately at $250/4-pack, $62.50/session (through the Company’s Custom Training offering), and access to their VOD library. They have additional plans available for members who want to train live more frequently and/or need more customization from a health coach.

FORME's services are accessible via download, streaming through their connected fitness hardware products, or streaming through the FORME Studio app, which is available through iOS/Android mobile devices and most iOS/Android tablets and computers.

FORME’s Quality is being validated by key industry gatekeepers!

The company also has an impressive and experienced management team including a CTO who worked at Peloton!

This is an exciting time to pay attention to FORME’s stock (Nasdaq: TRNR), as the company is now ready to commercialize after a recent IPO!

In the last five years, FORME has raised $120M from investors during development. The money from its IPO will help the company transition to rapid growth as it forges ahead with its commercialization efforts.

High-Quality Personal Trainers -

50 In-House and Growing

High-Quality Trainers – Better Value and Availability Through Virtual Sessions

Wellness Services are Gaining Share

and Coaching Services are Just Starting to Digitize.

In fitness, nearly 70% of spending has historically been weighted toward products rather than services, according to McKinsey. However, wellness services and apps are gaining ground. According to McKinsey, in 2022, approximately 45% of consumers intend to spend more on wellness services or app-based wellness services over the next year, while approximately 25% intend to spend more on fitness products.

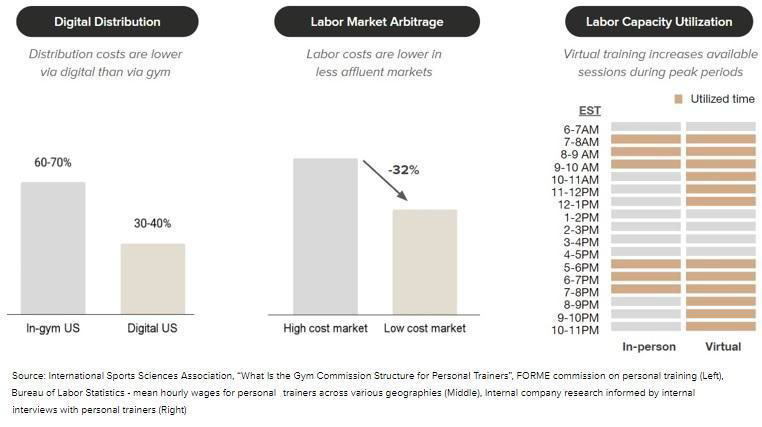

Health coaching can often result in optimal fitness outcomes because coaches offer expert guidance, accountability, and motivation, but the Company believes that these services have historically been inaccessible to many due to cost and lack of convenience. The company believes digitization can lower the cost of personal training and health coaching, primarily due to lower distribution costs relative to gyms. Further, digitization can increase peak capacity and utilization for service providers, and increase convenience for clients.

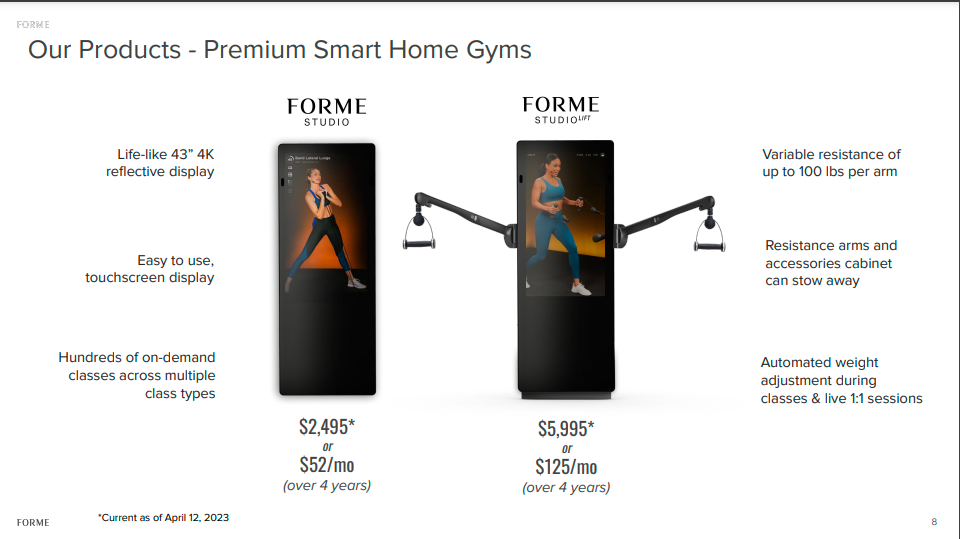

Studio Connected Fitness Hardware Products

The company’s connected fitness hardware products include the Studio, launched in 2021, the Studio Lift, launched in 2022, and various accessories, including the Barre attachment that can be used with both products. The Studio and Studio Lift were both designed to provide an immersive workout experience delivered through innovative hardware, software, and VOD content.

- Two smart home gym products - the Studio (fitness mirror) and the Studio Lift (fitness mirror + digital weight system)

- Designed by renowned industrial designer, Yves Behar

- Life-like 43” 4K reflective display (largest and highest res display on the market), Easy to use, touchscreen display, Automated weight adjustment during classes & live sessions, Variable resistance of up to 100 lbs per arm

- Recipient of multiple Smart Home Gym awards in 2023 from major fitness publications, including Men’s Health, Shape, and Good Housekeeping

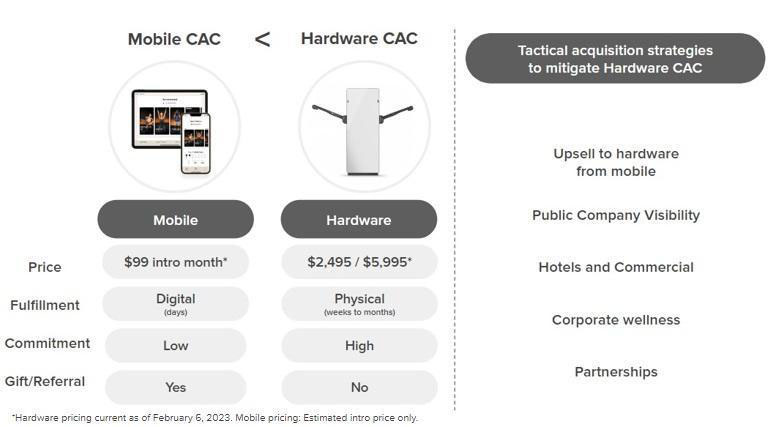

Go-to-Market Strategy Focused on Efficient Customer Acquisition

The design and technology of the platform enables members to engage in a virtual yet truly immersive training experience, whether through On-Demand classes or through Live 1:1 personal training services.

The company’s VOD content library and instruction and health coaching services are accessible via download or streaming through its connected fitness hardware products, as well as via streaming through the Studio app.

They are offered at different price points depending on format and, in the case of Live 1:1 training, personal training services, depending on the needs of the member and the experience level of the personal trainer.

Demand for Convenient Fitness Options

Household trends, work from home, and the rise of mobile technology make it challenging to balance time between family, work, and personal health and wellness, resulting in increasing demand for convenient fitness options. Digitization increases convenience of fitness options for consumers, enabling them to train from home and increasing flexibility to schedule with trainers from different time zones. Trainers are increasingly becoming attracted to digital platforms as well. Digital platforms reduce the time spent on traveling to clients, while value-added tech tools increase efficiency and effectiveness. According to the Personal Trainer Development Center, nearly 83% of trainers plan to offer virtual services compared to 40% of trainers prior to the COVID-19 pandemic.

Growth Strategies - Increase Uptake of Add-on Services Through Compelling Member Experience

The company intends to increase uptake of its add-on memberships and services by providing a compelling member experience focused on introducing members to the variety of services available on its platform and specifically, the value-added benefits of its coaching and personal training offering. believes their ability to provide service offerings at several price points will serve as a valuable lever for growth by increasing overall service revenues over time.

Business Model - Attractive Recurring Revenue Combined with Hardware

The company’s financing programs have successfully broadened their base of members by attracting consumers from a wider spectrum of ages and income levels.

A Big Addressable Market

Over the five years to 2022, revenue for the Personal Trainers industry is estimated to rise at an annualized rate of 1.9% to $12.3 billion, including a 0.2% increase in 2022 alone.

At-home fitness has really expanded its reach in the last two years, with 85% of those surveyed by GoodFirms emphasizing "the importance of emotional, mental, and spiritual health to promote overall physical wellness and quality of life."

Successful brands should seek ways to incorporate their products into a broader scope of wellness, looking at all forms of healing.

Companies like (NASDAQ: TRNR) with the vision to adapt, innovate and diversify health and fitness, stand to gain loyalty by bringing consumers more choice, more flexibility and more direction in how to train.

Growth Opportunity - Strength is Bigger than Cardio and Just Beginning

Sales and Marketing and Member Support

FORME’s goal is to increase brand awareness and purchase intent for its products and services. The company markets its products through various paid channels including Facebook and Google, as well as through unpaid channels driven by referrals and public relations initiatives.

Direct to Consumer, Multi-Channel Sales Mode

The company sells its products directly to customers through a multi-channel sales platform that includes e-commerce, inside sales, and retail locations and showrooms. Sales associates use customer relationship management tools to deliver a personalized and educational purchase experience.

IN SUMMARY

There’s now widespread availability of tech-inspired home gym equipment that’s creating a new culture of fitness and redefining what it means to work out from home.

Home gym systems have become more popular in the last year, and many consumers are opting to stick with at-home workouts instead of flocking to public gyms even as the pandemic winds down. Exercising at home appears here to stay and makes (NASDAQ: TRNR) a very exciting narrative to keep a close eye on!

Recently debuted on the NASDAQ with a current market cap of 90M, this fitness company may be on the precipice of garnering major market attention!

Start your research right away!

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

SCD Media LLC (d/b/a “Smallcaps Daily”), hereinafter referred to as “Smallcaps Daily,” and their affiliates and control

persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the

“Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in

exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.”

The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party”. The Paying

Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or

an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher

for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the

heading captioned, “Compensation”.

This website provides information about the stock market and other investments. This website does not provide

investment advice and should not be used as a replacement for investment advice from a qualified professional. This

website is for informational purposes only. The Author of this website is not a registered investment advisor and

does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should

seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein

should be made only after consulting with your personal investment advisor and only after performing your own

research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Smallcaps Daily, its managers, its employees, affiliates, and assigns (collectively the "Publisher") do not make any

guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

Release of Liability: through use of this website, viewing or using you agree to hold Smallcaps Daily, its operators,

owners, and employees harmless and to completely release them from any and all liability due to any and all loss

(monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The

information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being

accurate and does not purport to be a complete statement or summary of the available data. Smallcaps Daily

encourages readers and investors to supplement the information in these reports with independent research and

other professional advice. All information on featured companies is provided by the company profiled or is available

from public sources and Smallcaps Daily makes no representations, warranties, or guarantees as to the accuracy or

completeness of the disclosure by the profiled company. None of the materials or advertisements herein constitute

offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any

such company or other financial decisions should not be made based upon the information provided herein. Instead,

Smallcaps Daily strongly urges you to conduct a complete and independent investigation of the respective

companies and consideration of all pertinent risks. Smallcaps Daily’s full disclosure is to be read and fully understood

before using Smallcaps Daily's website, or joining Smallcaps Daily's email or text list. From time to time, Smallcaps

Daily will disseminate information about a company via website, email, sms, and other points of media. By viewing

Smallcaps Daily's website and/or reading Smallcaps Daily's email or text newsletter you are agreeing to this ---->

https://Smallcaps Daily.com/disclaimer/. All potential percentage gains discussed in any communications are based

on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising

companies for monetary compensation.

If you have questions or concerns about a product you’ve seen in one of our emails, emails, text newsletters or SMS,

we encourage you to reach out to that company directly.

Disclaimer – Always do your own research and consult with a licensed investment professional before investing. This

communication is never to be used as the basis of making investment decisions and is for entertainment purposes

only. At most, this communication should serve only as a starting point to do your own research and consult with a

licensed professional regarding the companies profiled and discussed. Conduct your own research. This newsletter

is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned,

operated, and edited by the owner of Smallcaps Daily. Any wording found in this e-mail or disclaimer referencing to “I”

or “we” or “our” refers to Smallcaps Daily. Our business model is to be financially compensated to market and

promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer,

which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide

investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment

recommendations. Companies with low prices per share are speculative and carry a high degree of risk, so only

invest what you can afford to lose. By using our service, you agree not to hold our site, its editors, owners, or staff

liable for any damages, financial or otherwise, that may occur due to any action you may take based on the

information contained within our newsletters or on our website. We do not advise any reader to take any specific

action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads.

Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains

mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and its

owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time

without notice to our subscribers, which may have a negative impact on share prices. If we own any shares, we will

list the information relevant to the stock and the number of shares here.

COMPENSATION

In compliance with section 17(b) of the Securities Act we are disclosing that we have been compensated a fee

pursuant to an agreement between Smallcaps Daily and TraDigital Marketing Group, Inc. (d/b/a/ “TraDigital IR”)

hereinafter referred to as TraDigital IR. Please see TraDigital IR’s disclosure page here. Smallcaps Daily was hired by

TraDigital IR for a period beginning January 2023 and ending January 2024 to publicly disseminate information about

Interactive Strength Inc. dba FORME via website, email, and sms. We were paid five thousand usd via ACH. Readers

are advised to review SEC periodic reports: forms 10Q 10K, form 8K, insider reports, forms 3, 4, 5 schedule 13d.

Smallcaps Daily is compliant with the CAN-SPAM Act of 2003. Smallcaps Daily does not offer investment advice or

analysis, and Smallcaps Daily further urges you to consult your own independent tax, business, financial, and

investment advisors. investing in micro-cap, small-cap, and growth securities is highly speculative and carries an

extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the

speculative nature of the companies profiled. The private securities litigation reform act of 1995 provides investors a

safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect

to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or

performance are not statements of historical fact but may be forward-looking statements. Forward-looking

statements are based on expectations, estimates, and projections at the time the statements are made that involve a

number of risks and uncertainties which could cause actual results or events to differ materially from those presently

anticipated. Forward-looking statements in this action may be identified through the use of words such as projects,

foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions &

quotes; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future

results in preparing this publication. Smallcaps Daily has relied upon information supplied by its clients, as well as its

clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can

not be guaranteed. Investors should not rely on the information contained on this website. Rather, investors should

use the information contained in this website as a starting point for doing additional independent research on the

featured companies. The advertisements in this website are believed to be reliable, however, Smallcaps Daily and its

owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the

completeness or accuracy of the information contained in any advertisement and for any omissions of material facts

from such advertisement. Smallcaps Daily is not responsible for any claims made by the companies advertised

herein, nor is Smallcaps Daily responsible for any other promotional firm, its program, or its structure. Smallcaps Daily

is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission, or FINRA.

Interactive Strength Inc. dba FORME. is a client of TraDigital IR, an investor relations and communications firm.

Please see TraDigital’s disclosures at www.tradigitalir.com.

Copyright © 2022 Smallcaps Daily. All rights reserved.