Industry Giants Conoco Phillips and Marathon Oil are Drilling Nearby. Could Lafayette Energy Corp. Emerge as the Next Big Oil & Gas Player?

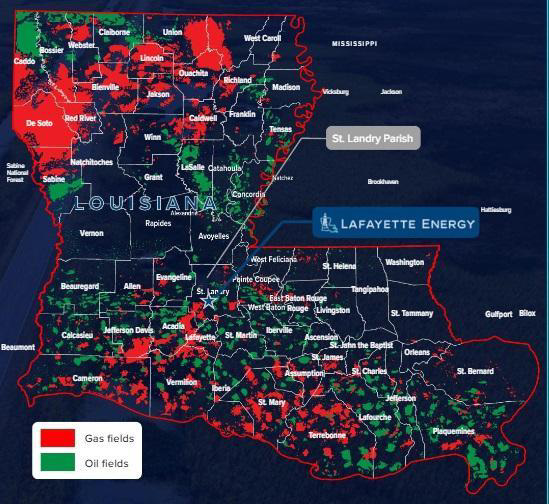

With a Focus on Louisiana – an Oil and Gas Hotbed – and a massive 64,000 acres to explore, Lafayette Energy Corp. looks positioned for a potentially significant discovery!

The Oil and Gas arena is booming, and Lafayette Energy Corp. is the newest company to make its Wall Street debut, bringing to the table acreage that has years of PROVEN production in MULTIPLE zones.

Company Overview

Lafayette Energy Corp. is a Denver, CO based Oil and Gas exploration company focused on developing its large 64,000 acre core project in Louisiana.

The company’s project has multiple target formations in largely underdeveloped proven oil and gas fields - some of the last, large, major producing fields without 3-D Seismic.

Download Research Report

The project is located in the Saint Landry Parish, South Louisiana In the updip Frio & along the oil rich Sparta-Wilcox trend. There are industry leaders nearby & producing wells on and around the project.

Phase 1 of project resource estimates are 848.49 BCF and 81.930 MMBO!

The Company plans to use the proceeds from its IPO toward the development of Phase 1 which comprises the northern 32,000 acres of the Imperial Parish Field. The Imperial Parish Fields have five proven reservoirs, or zones, including the Frio, Cockfield, Sparta, upper and lower Wilcox zones. All five zones have historically produced significant oil and gas by other operators through legacy traditional wells. The Company believes, based on the results of a 3-D shoot that was made of an adjacent area, that there is a highly prospective target in the deeper Tertiary and Cretaceous zones.

Based on the well results of the first four wells, the Company plans to drill two additional wells each quarter with the next six wells being called the 2nd Drilling Phase. The Company expects wells in the 2nd Drilling Phase can be completed with more efficiency allowing for the potential to complete the 2nd Drilling Phase within 18 months following the closing of its IPO.

IMPERIAL PARISH FIELD

Project Exploration and Development Program

Two-Stage 3-D Seismic Program:

- Each phase is ~50 sq miles (~130 sq km)

- 3-D Seismic Permits already acquired by the company's team. US Army Corp of Engineers Permits issued to Company on July 25, 2022.

- 3-D data will identify target drilling locations by defining structures and amplitudes for all objectives and relief features that could lead to field extensions or new fields.

Drill Program:

- Specific target prospects will be selected after interpreting 3-D data. This will support the potential to drill a significant number of new successful wells through better defined hydrocarbon traps.

All growth is expected to be strategically funded by Cash Flow with an anticipated $10M Reserve-Based Lending Facility. This means MINIMAL DEBT is required to execute the company’s growth plans!

Dear Investors,

Renewable energy is making inroads, but the global economy still relies heavily on petroleum products. Reports of the death of fossil fuel companies are greatly exaggerated….

Brutally high oil and gas prices were the talk of the town in 2022. While the S&P 500 was down more than 17% last year, shares of Exxon, Halliburton and Chevron were all up more than 45%.

Since Russia’s invasion of Ukraine in February 2022, the global supply of fossil fuels has been disrupted and caused oil and gas shortages worldwide.

Oil and gas giants have quietly enjoyed unprecedented record profits.

People across the United States have seen gas prices as high as $6 per gallon—stretching budgets thin. This, however, has helped oil giants rake in money, lining their shareholders’ pockets with profits

The rising prices and continued robust demand of oil and natural gas make this a great time to take a closer look at Lafayette Energy Corp., which may be on the verge of discovering an oil reserve right on U.S. soil!

The TOP 10 Reasons to Have Lafayette Energy Corp. on Your Radar:

- The company has an enormous amount of ground to explore with 64,000 acres of proven acreage in Louisiana, one of the top ten oil-producing states in the United States.

- 5 target zones have ALL BEEN PROVEN with traditional drilling.

- The acreage has never had 3-D seismic drilling, which potentially means significant reservoirs and structures could be identified for superior drilling results.

- 3-D seismic Permits were already issued by the US Army Corp of Engineers on July 25, 2022. This means the company has the green light to start 3-D seismic drilling.

- There are industry majors producing in adjacent, on-strike, and trend formations. This includes Conoco Philips,

- 35 miles SE of the company's project is a single well in Tuscaloosa Sand that is producing 1.2 BCF monthly with 107 BCF to date! With such success nearby, Lafayette Energy could potentially be sitting on a significant discovery.

- The O&G industry will likely enter 2023 with its healthiest balance sheet yet and with continued capital discipline according to Deloitte.

- The company has a strong management, development, and operations team with decades of experience in Louisiana.

- CEO Michael Peterson is a proven leader backed by experience that includes working at Goldman Sachs and Merrill Lynch. He has managed over a $7B asset portfolio and raised $100M when he built his first company and took it public! Peterson is now aiming to propel Lafayette Energy Corp. to the forefront of the massive O&G industry.

- Strong bench on the management team and board of directors to support and complement Mr. Peterson’s experience.

The Louisiana Opportunity

The first oil well in Louisiana was drilled in 1901… since then, the state has become a prolific energy producer.

With over 28,000 active wells, 9% of U.S. marketed gas production, and over 600 industry operators, Louisiana consistently ranks among the top oil and gas producers in the nation.

The state is a “launching point” for the offshore oil and gas industry, and has played a vital role in American energy security

Louisiana Quick Facts

- Louisiana ranks third in natural gas production and proved reserves among the states. Louisiana accounts for about 9% of U.S. total marketed natural gas production and holds about 8% of the nation's natural gas reserves.

- Louisiana's 14 oil refineries account for nearly one-fifth of the nation's refining capacity and can process about 3.2 million barrels of crude oil per day.

- In 2021, Louisiana shipped 52% of the nation's liquefied natural gas exports and about 13% of its coal exports.

- Louisiana's total energy consumption ranks fourth among the states and its per capita energy consumption is second, largely because of its energy-intensive chemical, petroleum, and natural gas industries.

- Louisiana has the second-highest per capita residential sector electricity consumption in the nation.

The Energy Sector is Shining

2022 witnessed skyrocketing gas prices at the pumps. Russia’s invasion of Ukraine and the sanctions that it sparked on Russian oil sent the price of crude soaring even in the U.S.

By June 2022, the average US gas price crossed $5 a gallon for the first time ever, hitting a record $5.02 on June 14th.

“Companies have pristine balance sheets, there’s very little near-term debt risk, and [they] are . . . moving forwards towards a net-cash position” while offering bumper dividends and share buyback programmes, said Matt Portillo, head of research at TPH&Co, an investment bank. “In a recessionary environment, that’s a great spot to be in.”

The advance in crude prices as a result of the war in Ukraine had boosted the sector, with US oil and gas companies recording a whopping $200bn in net profits in the two quarters following Russia’s full-scale invasion.

Heavy Insider Ownership

High insider ownership typically signals confidence in a company's prospects and ownership in its shares. This, in turn, gives the company's management an incentive to make the company profitable and maximize shareholder value.

Lafayette Energy Corp.’s current share structure includes management, founders, and board owning a whopping 75.2%!

Michael L. Peterson - CEO and Director

Michael Peterson is a proven leader and builder of growth companies for over 37 years. At the age of 25 he built his first company, raised $100 million, and took it public. He left to join Goldman Sachs & Co. where over an 11 year period he built a team of professionals that advised and managed over a $7 billion asset portfolio. He then joined Merrill Lynch as First Vice President to build a similar investment platform. He then departed to be founder and Managing Partner of a small-cap, early-stage focused Hedge Fund where he helped build, fund, and take small-cap growth companies public. For over 7 years he served in several executive officer positions – initially as CFO and then as CEO – at PEDEVCO Corp. (NYSE American: PED), a public company engaged primarily in the acquisition, exploration, development and production of oil and natural gas shale plays in the United States. Michael currently serves as director and chair of the audit committee of Indonesian Oil (NYSE: INDO) and is the lead director of Aesther Healthcare SPAC raising $100 million through NASDAQ IPO in September 2021. He has been the CEO, Chairman or lead director of 5 listed energy companies, including Aemetis, Inc. (formerly AE Biofuels Inc.), a global advanced biofuels and renewable commodity chemicals company, and also recently served as an independent director on the board of Trxade Group, Inc. (NASDAQ: MEDS). He received his M.B.A. from Brigham Young University’s Marriott School of Management and a Bachelor’s degree in statistics/computer science from Brigham Young University. He speaks fluent Mandarin Chinese.

Frank C. Ingriselli - Executive Chairman

Frank Ingriselli is a seasoned leader and entrepreneur with wide-ranging oil exploration and production experience spanning more than 42 years in the international energy industry. He is the CEO of Trio Petroleum Corp, a Californian Oil and Gas exploration company. He is also currently the President of Indonesia Energy Corporation (NYSE: INDO), engaged in the exploration, development and production of strategic, high-growth energy projects in Indonesia. Frank is the former founder, Chairman and CEO of PEDEVCO Corp. (NYSE: PED), which acquires and develops energy assets in the US, and is the former founder and CEO of Pacific Asia Petroleum, Inc., a NYSE publicly traded energy company with operations in Africa and China. Earlier in his career, he spent 23 years at Texaco, Inc. in senior executive positions involving E&P, merger and acquisition activities, pipeline operations, and corporate development, including serving as President of Texaco International Operations and President of Texaco Technology Ventures where he was responsible for over $1 billion of investments including numerous battery technology projects. Frank currently sits on the Board of NXT Energy Solutions Inc. (TSX:SFD) and sits on the Board of Trustees of the Eurasia Foundation. He graduated from Boston University with a B.S. in business administration, earned an M.B.A. from New York University, and a J.D. from Fordham University School of Law.

Greg Overholtzer - CFO

Greg currently serves as the Chief Financial Officer of Trio Petroleum Oil. Since 2019, Mr. Overholtzer has worked as a part time Chief Financial Officer of Indonesia Energy Corp. (NYSE AMERICAN: INDO). Since November 2019, Mr. Overholtzer has served as a Consulting Director of Ravix Consulting Group. From December 2018 until November 2019, Mr. Overholtzer served as a Field Consultant at Resources Global Professionals. From January 2012 until December 2018, Mr. Overholtzer served as the Chief Financial Officer, Chief Accounting Officer and Controller of Pacific Energy Development (NYSE AMERICAN: PED). Mr. Overholtzer holds a BA in Zoology and an MBA in Finance from the University of California, Berkeley.

Louis (Eddie) Bernard Jr. Managing Member of Project Operation

Richard G. Landry Senior Explorationist /Geologist

Kenneth MohnDirector of Seismic Operations/Geophysicist

Kenneth Mohn graduated from Stephen F. Austin University with a Bachelor of Science in Geology in 1983 and earned a Masters of Science in Geology in 1986. He attended Rice University’s Business Administration and Management Program. He worked, for 14 years in various positions such as Marketing, Sales, Project Management and Marketing Manager for the TGS Geophysical Company. In 2002, he worked as the Exploration Vice President for Fugro Multi Client Services, Inc. and then later as a Senior Sales Manager for CGG. In 2018, he was the Managing Director and Vice President for Multiclient Geophysical. In 2019, he opened Mohn & Associates where he works on acquiring and processing new Nodal 3-D seismic surveys, reprocessing of existing 3-D and 2-D data, data brokerage and business development.

Michael Lester Schilling, Jr. President of Land/Legal

Michael Lester Schilling, Jr. graduated with a Bachelor of Arts, Psychology, Louisiana State University, Baton Rouge, Louisiana, May 1971, and Juris Doctor, Paul M. Hebert, Law Center, Louisiana State University, Baton Rouge, May 1980. Upon graduating from law school, he entered into private practice in Abbeville, Louisiana, with Richard J. Putnam, Jr. and Darrel J. Hartman, with the major emphasis on general practice working private, corporate and government sections. In October 1996, he became the manager of the Title Division of Bernard Chiasson & Associates, a Land Management Firm. In February 1998, he opened Michael L. Schilling, Jr. & Associates. Areas of practice include oil and gas law, corporate and real estate. Majority of practice involved rendering oil, gas and mineral title opinions, preparing joint operating agreements, participation agreements, and other contracts regarding the exploration of minerals. Since 2000, his rm has served as in-house counsel for Saur Minerals, LLC, representing it in all phases of its operations.

In Summary…

5 Target Zones - all proven with traditional drilling: Frio, Cockfield, Sparta, Wilcox, and Lower Wilcox

Acreage has never had 3-D Seismic. Drilling with 3-D seismic expected to identify reservoirs and structures for superior drilling results

A single well in the Tuscaloosa Sand is producing 1.2 BCF monthly. The well is only 35 miles SE of Lafayette Energy's project!

Industry majors are neighbors which put the company in a hotbed of activity Lafayette Energy Corp. is focused on underdeveloped proven oil and gas fields - some of the last, large, major producing fields without 3-D Seismic. Remember, the company has already been given the green light to start 3-D Seismic drilling.

Insiders 75% ownership is a good indicator of confidence in the company's future.

With minimal debt necessary to execute the company's plans, 2023 could be a very exciting year for the company as they pursue significant development opportunities in the booming Oil & Gas space!

Learn More about Lafayette Energy Corp. by gaining access to the latest

research report

Download Report

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

SCD Media LLC (d/b/a “Smallcaps Daily”), hereinafter referred to as “Smallcaps Daily,” and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party”. The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation”.

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Smallcaps Daily, its managers, its employees, affiliates, and assigns (collectively the "Publisher") do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

Release of Liability: through use of this website, viewing or using you agree to hold Smallcaps Daily, its operators, owners, and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Smallcaps Daily encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the company profiled or is available from public sources and Smallcaps Daily makes no representations, warranties, or guarantees as to the accuracy or completeness of the disclosure by the profiled company. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Smallcaps Daily strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Smallcaps Daily’s full disclosure is to be read and fully understood before using Smallcaps Daily's website, or joining Smallcaps Daily's email or text list. From time to time, Smallcaps Daily will disseminate information about a company via website, email, sms, and other points of media. By viewing Smallcaps Daily's website and/or reading Smallcaps Daily's email or text newsletter you are agreeing to this ----> https://Smallcaps Daily.com/disclaimer/. All potential percentage gains discussed in any communications are based on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising companies for monetary compensation.

If you have questions or concerns about a product you’ve seen in one of our emails, emails, text newsletters or SMS, we encourage you to reach out to that company directly.

Disclaimer – Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated, and edited by the owner of Smallcaps Daily. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to Smallcaps Daily. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Companies with low prices per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website. We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares, we will list the information relevant to the stock and the number of shares here.

COMPENSATION

In compliance with section 17(b) of the Securities Act we are disclosing that we have been compensated a fee pursuant to an agreement between Smallcaps Daily and TraDigital Marketing Group, Inc. (d/b/a/ “TraDigital IR”) hereinafter referred to as TraDigital IR. Please see TraDigital IR’s disclosure page here. Smallcaps Daily was hired by TraDigital IR for a period beginning July 2022 and ending January 2023 to publicly disseminate information about Lafayette Energy Corp., via website, email, and SMS. We were paid five thousand USD via ACH. Readers are advised to review SEC periodic reports: forms 10Q 10K, form 8K, insider reports, forms 3, 4, 5 schedule 13d. Smallcaps Daily is compliant with the CAN-SPAM Act of 2003. Smallcaps Daily does not offer investment advice or analysis, and Smallcaps Daily further urges you to consult your own independent tax, business, financial, and investment advisors. investing in micro-cap, small-cap, and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. The private securities litigation reform act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or performance are not statements of historical fact but may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results in preparing this publication. Smallcaps Daily has relied upon information supplied by its clients, as well as its clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can not be guaranteed. Investors should not rely on the information contained on this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, Smallcaps Daily and its owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Smallcaps Daily is not responsible for any claims made by the companies advertised herein, nor is Smallcaps Daily responsible for any other promotional firm, its program, or its structure. Smallcaps Daily is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission, or FINRA.

Lafayette Energy Corp. is a client of TraDigital IR, an investor relations and communications firm. Please see TraDigital’s disclosures at www.tradigitalir.com.

Copyright © 2022 Smallcaps Daily. All rights reserved.