This Digital Infrastructure Provider is Seeing Explosive Revenues as it Promotes the Global Transition to the New Digital Economy!

With exploding revenues, Mawson Infrastructure Group, Inc. (NASDAQ: MIGI) could be one of the most promising opportunities to emerge on the NASDAQ…

MIGI is a digital infrastructure provider with multiple operations throughout the USA and Australia. MIGI’s vertically integrated model is based on a long-term strategy to promote the global transition to the new digital economy.

These days, “digital economy” has become a hot topic and proves that digital assets are here to stay.

As of 2021, Triple A estimated global crypto ownership rates at an average of 3.9%, with over 300 million crypto users worldwide. And over 18,000 businesses are already accepting cryptocurrency payments!

For the very first-time last year, Bitcoin's market cap hit an astonishing $1 trillion!

It's hard to imagine that at one point Bitcoin was trading at only 9 cents.

It's not surprising that several analysts see solid growth prospects for cryptocurrency miners...

One of the stronger plays, according to many Wall Street pros, is in crypto miners. "Cryptocurrency 'mining' is the process through which the blockchain is secured and new cryptocurrency coins are brought into circulation," says Jefferies analyst Jonathan Petersen.

Mawson Infrastructure Group, Inc (NASDAQ: MIGI) is proving itself as a leader as the cryptocurrency market continues to show impressive growth!

MIGI also has strategic partnerships with vendors such as Canaan.io; a world leader in cryptocurrency mining architecture.

The partnership allows for the company's mining facility to “scale-on-demand” as the asset class value increases.

It’s no secret that mining for digital coin has come under fire for allegedly being bad for the environment, which is why it’s important to have companies like MIGI who is apart of the Crypto Climate Accord (CCA).

The CCA, inspired by the Paris Climate Agreement, is a private sector-led initiative for the entire crypto community focused on decarbonizing the cryptocurrency and blockchain industry.

The CCA’s goal is to decarbonize the global crypto industry by prioritizing climate stewardship and supporting the entire crypto industry’s transition to net-zero greenhouse gas emissions by 2040!

MIGI is committed to being a sustainable Bitcoin Miner and uses sustainable energy including nuclear, wind and hydro, as part of the company’s broader commitment to Net Zero Carbon 2030!

"We are delighted to join the Crypto Climate Accord as a Supporter and are excited to be part of like-minded groups who, like Mawson, are working towards achieving Net Zero Carbon emissions. Our integrated model is based on a long-term strategy to assist in the global transition to a decarbonized society."

James Manning, CEO and Founder of Mawson

Even more impressive, MIGI recently released their 2022 Q1 results which were up 178% from 2021, at a whopping $19.4 million in revenue and $11 in gross profit!

"Q1 2021 was a solid operational quarter for our business. We significantly increased our Bitcoin self-mining operational footprint, producing 459 Bitcoin in Q1, delivered Q1 revenue of $19.4 million, up 178% vs Q1 2021, delivered Q1 gross profit of $11.0 million, up 138% vs Q1 2021, and posted Q1 non-GAAP EBITDA of $4.5 million, up 160% vs Q1 2021.

James Manning, CEO and Founder of Mawson

The company also recently announced the exciting listing of Cosmos Asset Management’s (the company’s second product, the Cosmos-Purpose Bitcoin Access ETF.

An investment in CBTC gives investors access to the underlying Bitcoin asset, in a regulated, familiar, liquid and publicly listed structure.

With exciting and strategic partnerships, impressive revenue growth, and innovative business models, Mawson Infrastructure Group, Inc (NASDAQ: MIGI) is emerging as a global leader in ESG focused Bitcoin mining and digital infrastructure!

THE TOP REASONS TO HAVE MIGI ON YOUR RADAR:

- The company recently announced plans to develop a 120 Megawatt Bitcoin Mining facility in Texas. MIGI intends to utilize both Carbon Credits and Renewable Energy Credits (RECs) for their new facility, as well as to ensure Net Zero Carbon and strong ESG focus is maintained. The sites have been selected due to the substantial local infrastructure already available to Mawson.

- The company released its Q1 financial report with staggering and impressive results with revenue growth up 178% from 2021’s Q1.

- Sitting in hot markets like the extremely profitable Bitcoin market, which is estimated to hit $100,000 this year, puts MIGI in an exciting position as it delves into its bitcoin mining operations.

- The digital infrastructure economy is emerging as an exciting player as digital technology drives its growth. The market is expected to continue its growth as more people and more businesses delve into the digital world. MIGI is already proving to be a leader in the digital infrastructure world and if trends indicate anything, they will continue to BOOM.

- Since its launch in 2009, Bitcoin has become the world’s best-known and most popular cryptocurrency exchange, with more than 81 million users worldwide! It’s estimated that 106 million people world-wide use some form of crypto-currency and 46 million Americans alone own a share of Bitcoin!

The interest in Cryptocurrencies and Digital Infrastructure is at an all-time high, which points to companies like Mawson Infrastructure Group, Inc (NASDAQ: MIGI) to have on your radar!

Greetings Investors,

Digital-coin, cryptocurrency, bitcoin; these are all pretty common words these days with more attention than ever on the digital economy. In fact, as of March 2022, more than 81 million people created digital wallets on blockchain.com. That number is up 72% from 2018!

For the very first-time last year, Bitcoin's market cap hit an astonishing $1 trillion with Bitcoin’s price estimated to reach $100,000 in 2022!

It's not surprising that several analysts see solid growth prospects for cryptocurrency miners. One of the stronger plays, according to many Wall Street pros, is in crypto miners.

Cryptocurrency 'mining' is the process through which the blockchain is secured and new cryptocurrency coins are brought into circulation," says Jefferies analyst Jonathan Petersen.

More people are jumping into cryptocurrency, mainly because of how easy it's become to trade the digital assets, a CNBC/Momentive Invest in You survey found. More than 10% of those surveyed said they're invested in cryptocurrency, ranking the digital coins fourth after real estate, stocks, mutual funds and bonds.

“There are a lot of things that make crypto very attractive; the biggest one is the opportunity to make a lot of money,” said Douglas Boneparth, a certified financial planner and president of Bone Fide Wealth in New York.

However, with this growth comes its challenges. Mining for crypto can be very hard on the environment and in recent years has become a huge concern of many. In fact, many of the youth are looking for way to invest in GREEN crypto.

The Crypto Climate Accord (CCA) is dedicated to a private sector-led initiative for the entire crypto community focused on decarbonizing the cryptocurrency and blockchain industry in record time.

Fortunately, companies like Mawson Infrastructure Group, Inc (NASDAQ: MIGI), a member of the CCA, are dedicated to sustainable mining and are paving the way for the future of the digital economy.

ABOUT THE COMPANY

U.S. and Australia based, Mawson Infrastructure Group, Inc. (NASDAQ: MIGI) is a blockchain focused company whose innovative business model is to solve a global problem: the large mismatch between energy generation and end-users.

Established in 2019, Cosmos Capital Pty Ltd began testing its proof-of-concept Modular Data Centre with purpose-built High Performance Computing in the USA, co-locating adjacent to stranded or under-utilized energy sources. Upon successful completion, Cosmos began to scale its operation rapidly, deploying ASIC's across multiple sites in the USA.

In the late 2020s, Cosmos underwent a reverse takeover of Wize Pharma, and thus was born Mawson Infrastructure Group, Inc (NASDAQ: MIGI).

COMPANY HIGHLIGHTS

- MIGI is a digital infrastructure provider with multiple operations throughout the USA and Australia. Mawson’s vertically integrated model is based on a long-term strategy to promote the global transition to the new digital economy.

- MIGI matches sustainable energy infrastructure with next-generation mobile data centre (MDC) solutions, enabling low-cost Bitcoin production and on-demand deployment of infrastructure assets. With a strong focus on shareholder returns and an aligned board and management, MIGI is emerging as a global leader in ESG focused Bitcoin mining and digital infrastructure.

- The company currently operates in flagship facility in Sandersville, Georgia. In 2022 Mawson Infrastructure Group Inc. has large scale facilities in Sandersville, GA, USA and Midland, PA, USA. Mawson also operates a facility with Quinbrook in Condong, NSW, Australia. The company has a qualified pipeline of more than 1GW of power!

DIGITAL ASSET MINING

Purpose-built blockchain compute

MIGI’s blockchain mining division leverages the latest in compute technology to consistently deliver high yield per kw/hr. With a dedicated research and development department, MIGI is leading the way in creating efficiency in digital asset creation transactions.

The company’s strategic partnership with vendors such as Canaan.io, a world leader in cryptocurrency mining architecture, allows for their mining facility to “scale-on-demand" as the asset class value increases.

Research and Development

With a dedicated R&D team, MIGI is constantly seeking alternative options to reduce energy consumption and limit its environmental impact in accordance with its ESG policy.

A major development in compute lifecycle management is harnessing Liquid Immersion Technology which was proven to yield greater performance, longer system life and higher uptime than traditional air-cooled system architecture.

INFRASTRUCTURE AND HOSTING

Luna Squares

Luna Squares, a subsidiary of MIGI, strategically positions itself as a leader in energy efficient, purpose built, hosting infrastructure that has been designed exclusively for the operation of blockchain based High Performance Computing.

By establishing its facilities close to key energy sources, including renewables, Luna Squares delivers a scalable platform that meets both current and future sustainability targets.

The company provides wholesale hosting solutions for medium to large scale mining operations at sites located throughout the USA.

Modular Data Centre

Luna’s Modular Data Centre (MDC) design is both scalable and flexible to allow for rapid deployment of new customer facilities, without upfront sunk capital being stranded in

unutilized data-centre real estate. This innovative model allows for significant commercial benefit to the operational cost of the company whilst providing limitless scalability to future customers deployments.

Infrastructure Optimization

Significant Intellectual Property (IP) sits within our MDC's, hardware purchases and site selection process - including power contracts, site layout and construction, MDC configuration, cooling, sysops and network management. A key part of Luna’s service offering is to ensure optimal facilities for its customers that met both performance and cost benchmarks, day in and day out.

DIGITAL ASSEST MANAGEMENT

Cosmos Asset Management is an Australian-based Digital Asset Investment Manager offering investors access and insight into new digital investment opportunities.

Cosmos Global Digital Miners Access ETF

The DIGA ETF is designed to provide access to global leaders listed on national exchanges with a focus on cryptocurrency asset mining and infrastructure.

Bitcoin Wholesale Access Fund

Bitcoin-only wholesale fund for sophisticated and institutional investors.

Institutional Custody Solutions

We have a long-term partnership with Australia’s most trusted digital currency exchange. They feature best in class local security storage with multi-level encryption for the safekeeping of digital assets.

World Class Management

Our influential leadership has a proven track record of delivering global intelligent investment solutions to investors.

Industry Experts

Mawson's experienced team has over 15 years of experience in digital currency technology and funds management.

THE MIGI POTENTIAL

Highlights from the company's Q1 2022 report include:

- Q1 2022 revenue of $19.4 Million, up 178% vs Q1 2021

- Q1 2022 gross profit of $11.0 Million, up 138% v Q1 2021

- Q1 2022 non-GAAP EBITDA of $4.5 Million, up 160% v Q1 2021

- 459 Self-mined Bitcoin produced in Q1 2022, up 272% v Q1 2021

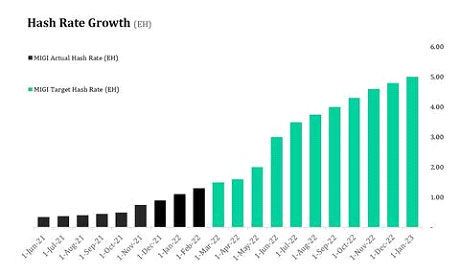

- Mawson Self-Mining Exahash targets upgraded in March to 4.0 Exahash online by Q3, 2022, and 5.5 Exahash online by early Q1, 2023

- New 100-megawatt hosting co-location customer Celsius Mining LLC signed and first mining hardware online

- New 12-megawatt hosting co-location customer Foundry Digital LLC signed and first mining hardware online

- 230-megawatt expansion at Georgia, USA facility approved, capable of accommodating up to 7.5 Exahash

- Mawson’s substantial secured infrastructure pipeline (energy capacity available for Bitcoin Mining, Modular Data Centre’s, transformers, switch gear) continues to be deployed at pace, a significant competitive advantage in the current climate

"Revenues grew rapidly in the third quarter to $10.9 million, driving a revenue increase of 1100% vs Q3 2020, on the increasing price of bitcoin and further ASIC bitcoin miner deployments. In addition, gross profit grew to $8.4 million during the quarter, illustrating the profitability of our business as we continue to scale."

"Q3 was a busy quarter for the team as we successfully listed on the Nasdaq Capital Market, added over 17,000 ASIC bitcoin miners to our fleet, signed a new 100MW facility in Pennsylvania and kicked off the expansion of our Georgia facility which will have 100MW of available energy by early Q1 2022. We now look forward to the significant scale up of operations into year end and beyond and look forward to keeping shareholders up to date on developments on this front in due course."

- James Manning, CEO and Founder of MIGI

2022 Strategic Focus

- New 120 megawatt Bitcoin Mining facility to be developed in Texas, capable of accommodating up to 4.0 Exahash, with mining hardware expected to be online in Q4, 2022

- Expand existing Bitcoin self-mining operations from the expected end of May hash rate of 1.8 Exahash, to our target of 4.0 Exahash by Q3, 2022 and to our target of 5.5 Exahash by early Q1 2023.

- Expand Mawson’s hosting co-location business from the expected 52 megawatts online by the end of May, to 116 megawatts now contracted, and beyond.

- Continue the ongoing expansion of the company’s Georgia, Pennsylvania, Texas and Australian Bitcoin Mining facilities.

- Continue to assess, and where appropriate, add more Bitcoin mining facilities to the global portfolio.

- Continue to assess, and where appropriate, add more Bitcoin miners to global operations.

- Evaluate opportunities to decrease the overall costs of Bitcoin production.

- Continue with their strong ESG focus across the business.

Expected Hash Rate Growth:

MIGI expects Bitcoin Self-Mining to be at 3.35 EH by Q2, 2022, and a target of 5 EH online by early Q1 2023 reiterated.

“February was another solid month of operational growth for the group – we produced a record 152 Bitcoin – the highest amount of self-mined Bitcoin in the company’s history."

James Manning, CEO and Founder of Mawson

MORE IMPRESSIVE MILESTONES

The company recently announced the listing of the Cosmos-Purpose Bitcoin access ETF in Australia alongside market leaders Purpose Investments Inc and Gemini Trust Company LLC.

The CBTC holds units in the Purpose Bitcoin ETF (BTCC.U), the world’s first physically settled Bitcoin ETF, with approximately US$1.2BN in Assets Under Management – An investment in CBTC gives investors access to the underlying Bitcoin asset, in a regulated, familiar, liquid and publicly listed structure.

Mawson Infrastructure Group and Voltus Partner to Deliver a 100 Megawatt Virtual Power Plant to PJM THIS YEAR!

MIGI plans to deliver 100 megawatts (MWs) of distributed energy resources to the PJM electricity grid in 2022.

Mawson is building a new 100 MW cryptomining facility on the grounds of a former industrial site in Midland, Pennsylvania with the intention of bringing 50 MWs of load online by March 2022 and an additional 50 MWs by June 2022. This capacity is expected to be available to PJM’s grid operators as a grid balancing resource 24/7/365 through the Voltus DER marketplace software platform

Mawson Infrastructure Group Announces New 12 Megawatt Hosting Co-location Agreement with Foundry Digital LLC.

The company has signed a new 12 megawatt (MW) hosting co-location agreement with Foundry Digital LLC, bringing total hosting co-location under Mawson’s Luna Squares LLC business to 114 MW, up from 2 MW as at 31 December, 2021.

THE COMPANY TEAM

James Manning

Chief Executive Officer, Executive Director, Founder

James has over 15 years' experience across technology, accounting, logistics and property development, and brings unique insight into the practical deliverables as well as the complex regulatory and cross border transactions required in running the various business units within Mawson Infrastructure Group. James has previously managed large projects across various industries including construction, financial services, technology and cross-border logistics, and founded Mawson Infrastructure Group to leverage the opportunity that exists between energy and digital asset infrastructure.

Hetal Majithia

Chief Financial Officer

Hetal has over 10 years’ experience as a chartered accountant, having worked previously at PwC and KPMG in Australia and the United Kingdom respectively. Hetal has an Economics degree (Honours) from the University of Southampton and is a member of the Institute of Chartered Accountants in England and Wales.

Liam Wilson

Chief Operating Officer

Liam has over 16 years experience in senior operational management roles across multiple industries, and is responsible for the operations of Mawson Infrastructure Group globally. Liam works closely with our various partners and suppliers across Australia, Asia and the USA. Liam has held Group Senior Management positions for Event Hospitality & Entertainment (ASX:EVT), The Rockpool Dining Group and The Whitehouse Group.

Nick Hughes-Jones

Chief Commercial Officer

Nick has over 15 years' experience in financial markets and funds management, and as Chief Commercial Officer is responsible for the corporate strategy and development of Mawson Infrastructure Group. Nick has been involved with Mawson since inception, and prior to joining worked at Bell Financial Group and Southern Cross Equities, two of Australia’s leading equities and funds management groups. Nick holds a bachelor of Commerce (Corporate Finance/Business Law) from the University of Sydney.

Heath Donald

Chief Marketing Officer

Heath is a dynamic and innovative marketer with 25 years’ experience across a range of industries. Heath has a deep understanding of what it takes to get businesses maximum exposure in the competitive digital age. His passion is for creating, communicating and delivering new and exciting offerings that unlock multi-national scale and high returns.

Craig Hibbard

Chief Development Officer

Craig has over 15 years’ experience in business leadership and delivery of major projects within the property, development and real estate sectors in Australia. As Chief Development Officer, Craig brings an accelerated view to project deployment across US and Australian facilities at a pivotal growth phase of the business. Craig previously held senior executive positions at Iris Capital, Property Partnership Australia (PPA) and Merivale.

THE BOTTOM LINE

Australia and U.S-based, Mawson Infrastructure Group, Inc (NASDAQ: MIGI) is a digital infrastructure provider with a vertically integrated model is based on a long-term strategy to promote the global transition to the new digital economy.

MIGI recently released impressive 2022 Q1 financial revenue results which were up 178% from the year prior.

The company’s many strategic partnerships with vendors such as Canaan.io; a world leader in cryptocurrency mining architecture, put them in a favorable position to become a leader in the digital economy market!

For the very first-time last year, Bitcoin's market cap hit an astonishing $1 trillion and the price of Bitcoin is estimated to reach a whopping $100,000 in 2022!

MIGI is a blockchain focused company whose innovative business model is to solve a global problem; the large mismatch between energy generation and end-users.

With impressive revenue growth, exciting partnerships, and up and coming mining operations in development, MIGI is rising to the top of its sector and now is the time to be paying attention to this growing leader!

Hurry and Start Your Research Today!

THIS WEBSITE IS WHOLLY OWNED BY TRADIGITAL MARKETING GROUP, INC. (D/B/A “TRADIGITAL IR”). OUR REPORTS ARE ADVERTORIALS AND ARE FOR GENERAL INFORMATION PURPOSES ONLY. NEVER INVEST IN ANY STOCK FEATURED ON OUR SITE OR EMAILS UNLESS YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. THE DISCLAIMER IS TO BE READ AND FULLY UNDERSTOOD BEFORE USING OUR SERVICES, JOINING OUR EMAIL LIST, AS WELL AS ANY SOCIAL NETWORKING PLATFORMS WE MAY USE. PLEASE NOTE WELL: TRADIGITAL IR AND ITS EMPLOYEES ARE NOT REGISTERED INVESTMENT ADVISORS, BROKER-DEALERS, OR MEMBER(S) OF ANY ASSOCIATION FOR OTHER RESEARCH PROVIDERS IN ANY JURISDICTION WHATSOEVER. RELEASE OF LIABILITY: THROUGH USE OF THIS WEBSITE, VIEWING OR USING YOU AGREE TO HOLD TRADIGITAL IR, ITS OPERATORS, OWNERS, AND EMPLOYEES HARMLESS AND TO COMPLETELY RELEASE THEM FROM ANY AND ALL LIABILITY DUE TO ANY AND ALL LOSS (MONETARY OR OTHERWISE), DAMAGE (MONETARY OR OTHERWISE), OR INJURY (MONETARY OR OTHERWISE) THAT YOU MAY INCUR. THE INFORMATION CONTAINED HEREIN IS BASED ON SOURCES THAT WE BELIEVE TO BE RELIABLE BUT IS NOT GUARANTEED BY US AS BEING ACCURATE AND DOES NOT PURPORT TO BE A COMPLETE STATEMENT OR SUMMARY OF THE AVAILABLE DATA. TRADIGITAL IR ENCOURAGES READERS AND INVESTORS TO SUPPLEMENT THE INFORMATION IN THESE REPORTS WITH INDEPENDENT RESEARCH AND OTHER PROFESSIONAL ADVICE. ALL INFORMATION ON FEATURED COMPANIES IS PROVIDED BY THE COMPANIES PROFILED OR IS AVAILABLE FROM PUBLIC SOURCES AND TRADIGITAL IR MAKES NO REPRESENTATIONS, WARRANTIES, OR GUARANTEES AS TO THE ACCURACY OR COMPLETENESS OF THE DISCLOSURE BY THE PROFILED COMPANIES. NONE OF THE MATERIALS OR ADVERTISEMENTS HEREIN CONSTITUTE OFFERS OR SOLICITATIONS TO PURCHASE OR SELL SECURITIES OF THE COMPANIES PROFILED HEREIN AND ANY DECISION TO INVEST IN ANY SUCH COMPANY OR OTHER FINANCIAL DECISIONS SHOULD NOT BE MADE BASED UPON THE INFORMATION PROVIDED HEREIN. INSTEAD, TRADIGITAL IR STRONGLY URGES YOU TO CONDUCT A COMPLETE AND INDEPENDENT INVESTIGATION OF THE RESPECTIVE COMPANIES AND CONSIDERATION OF ALL PERTINENT RISKS. TRADIGITAL IR’S FULL DISCLOSURE IS TO BE READ AND FULLY UNDERSTOOD BEFORE USING TRADIGITAL IR'S WEBSITE, OR JOINING TRADIGITAL IR'S EMAIL OR TEXT LIST. FROM TIME TO TIME, TRADIGITAL IR WILL DISSEMINATE INFORMATION ABOUT A COMPANY VIA WEBSITE, EMAIL, SMS, AND OTHER POINTS OF MEDIA. BY VIEWING TRADIGITAL IR'S WEBSITE AND/OR READING TRADIGITAL IR'S EMAIL OR TEXT NEWSLETTER YOU ARE AGREEING ----> HTTPS://TRADIGITALIR.COM/DISCLAIMER-TMG/. ALL POTENTIAL PERCENTAGE GAINS DISCUSSED IN ANY COMMUNICATIONS ARE BASED ON CALCULATIONS FROM THE LOW TO THE HIGH OF THE DAY. WE ARE ENGAGED IN THE BUSINESS OF MARKETING AND ADVERTISING COMPANIES FOR MONETARY COMPENSATION. IN COMPLIANCE WITH SECTION 17(B) OF THE SECURITIES ACT WE ARE DISCLOSING THAT WE HAVE BEEN COMPENSATED A FEE PURSUANT TO AN AGREEMENT BETWEEN TRADIGITAL AND PASITHEA THERAPEUTICS CORP. TRADIGITAL WAS HIRED FOR A PERIOD BEGINNING JANUARY 2022 AND ENDING MARCH 2022 TO PUBLICLY DISSEMINATE INFORMATION ABOUT PASITHEA THERAPEUTICS CORP. VIA WEBSITE, EMAIL, AND SMS. WE WERE PAID FIVE HUNDRED FORTY-FOUR THOUSAND USD VIA ACH. WE OWN ONE HUNDRED FIFTY THOUSAND RESTRICTED COMMON SHARES OF PASITHEA THERAPEUTICS CORP., WHICH ARE ELIGIBLE FOR SALE ON 03/18/2022. FOR THE PURPOSE OF THIS DISCLAIMER, WE SUGGEST THAT YOU ASSUME WE WILL SELL ALL OF OUR SHARES ONCE THE RESTRICTION IS LIFTED ON 03/18/2022. READERS ARE ADVISED TO REVIEW SEC PERIODIC REPORTS: FORMS 10-Q, 10K, FORM 8-K, INSIDER REPORTS, FORMS 3, 4, 5 SCHEDULE 13D. TRADIGITAL IR IS COMPLIANT WITH THE CAN-SPAM ACT OF 2003. TRADIGITAL IR DOES NOT OFFER INVESTMENT ADVICE OR ANALYSIS, AND TRADIGITAL IR FURTHER URGES YOU TO CONSULT YOUR OWN INDEPENDENT TAX, BUSINESS, FINANCIAL, AND INVESTMENT ADVISORS. INVESTING IN MICRO-CAP, SMALL-CAP, AND GROWTH SECURITIES IS HIGHLY SPECULATIVE AND CARRIES AN EXTREMELY HIGH DEGREE OF RISK. IT IS POSSIBLE THAT AN INVESTORS INVESTMENT MAY BE LOST OR IMPAIRED DUE TO THE SPECULATIVE NATURE OF THE COMPANIES PROFILED.THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 PROVIDES INVESTORS A SAFE HARBOR IN REGARD TO FORWARD-LOOKING STATEMENTS. ANY STATEMENTS THAT EXPRESS OR INVOLVE DISCUSSIONS WITH RESPECT TO PREDICTIONS, EXPECTATIONS, BELIEFS, PLANS, PROJECTIONS, OBJECTIVES, GOALS, ASSUMPTIONS OR FUTURE EVENTS, OR PERFORMANCE ARE NOT STATEMENTS OF HISTORICAL FACT MAY BE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS ARE BASED ON EXPECTATIONS, ESTIMATES, AND PROJECTIONS AT THE TIME THE STATEMENTS ARE MADE THAT INVOLVE A NUMBER OF RISKS AND UNCERTAINTIES WHICH COULD CAUSE ACTUAL RESULTS OR EVENTS TO DIFFER MATERIALLY FROM THOSE PRESENTLY ANTICIPATED. FORWARD-LOOKING STATEMENTS IN THIS ACTION MAY BE IDENTIFIED THROUGH THE USE OF WORDS SUCH AS PROJECTS, FORESEE, EXPECTS, WILL, ANTICIPATES, ESTIMATES, BELIEVES, UNDERSTANDS, OR THAT BY STATEMENTS INDICATING CERTAIN ACTIONS & QUOTES; MAY, COULD, OR MIGHT OCCUR. UNDERSTAND THERE IS NO GUARANTEE PAST PERFORMANCE WILL BE INDICATIVE OF FUTURE RESULTS IN PREPARING THIS PUBLICATION, TRADIGITAL IR HAS RELIED UPON INFORMATION SUPPLIED BY ITS CLIENTS, AS WELL AS ITS CLIENTS’ PUBLICLY AVAILABLE INFORMATION AND PRESS RELEASES WHICH IT BELIEVES TO BE RELIABLE; HOWEVER, SUCH RELIABILITY CAN NOT BE GUARANTEED. INVESTORS SHOULD NOT RELY ON THE INFORMATION CONTAINED ON THIS WEBSITE. RATHER, INVESTORS SHOULD USE THE INFORMATION CONTAINED IN THIS WEBSITE AS A STARTING POINT FOR DOING ADDITIONAL INDEPENDENT RESEARCH ON THE FEATURED COMPANIES. THE ADVERTISEMENTS IN THIS WEBSITE ARE BELIEVED TO BE RELIABLE, HOWEVER, TRADIGITAL IR AND ITS OWNERS, AFFILIATES, SUBSIDIARIES, OFFICERS, DIRECTORS, REPRESENTATIVES, AND AGENTS DISCLAIM ANY LIABILITY AS TO THE COMPLETENESS OR ACCURACY OF THE INFORMATION CONTAINED IN ANY ADVERTISEMENT AND FOR ANY OMISSIONS OF MATERIALS FACTS FROM SUCH ADVERTISEMENT. TRADIGITAL IR IS NOT RESPONSIBLE FOR ANY CLAIMS MADE BY THE COMPANIES ADVERTISED HEREIN, NOR IS TRADIGITAL IR RESPONSIBLE FOR ANY OTHER PROMOTIONAL FIRM, ITS PROGRAM, OR ITS STRUCTURE. TRADIGITAL IR IS NOT AFFILIATED WITH ANY EXCHANGE, ELECTRONIC QUOTATION SYSTEM, THE SECURITIES EXCHANGE COMMISSION, OR FINRA.