Aesthetic Medical is Resilient, Growing, and Attracting Investors. This Leading Franchisor of Medical Clinics has a Foundation of Strong Growth - and More to Come

Japanese consumer demand for aesthetic medical treatments continues to experience rapid growth, and SBC Medical Group Holdings (SBC) is well-positioned..

The franchisee clinics have expanded to 224 primarily in Japan, SBC leads the largest network of aesthetic and medical clinics in the country.

Download Investor Presentation

Recent Company News

- 8/15/2024 SBC Medical Lands $700 Million Fortune for Japanese Founder - Bloomberg Article

- 1/20/2025 SBC Medical Launches Translation App Specialized Medical Aesthetics and Strengthens "Inbound- Focused Clinics" Initiative

- 12/20/2024 SBD Medical Group Co. LTD. Sells Two Subsidiaries.

- 11/19/2024 SBC Medical Launches SBC Wellness, A New Solution to Help Companies Deliver Additional Health Benefits and Enhance Employee Wellbeing.

- 11/18/2021 SBC Medical Group Holdings Announces Definite Agreement to Acquire Aesthetic Healthcare Holdings PTE. LTD, A Multi-Unit Owner of Aesthetic Treatment Clinics in Singapore.

- 11/13/2024 SBC Medical Group Holdings Inc. Reports Third Quarter 2024 Financial Results.

Key Industry Highlights

- According to Straits Research, the global medical aesthetics market is estimated to grow at a 10% CAGR, reaching $245 billion by 2030, up from $105 billion in 2022. We believe favorable demographic and cultural trends will drive robust growth. Older consumers are turning to surgical aesthetic treatments to address wrinkles and fine lines, while younger consumers, influenced by social media, are adopting med spa services for preventive benefits.

- Straits Research projects the Asia-Pacific aesthetic medicine market will grow at a CAGR of 11% through 2030, reaching $64.2 billion, driven by increasing disposable incomes, demand for anti-aging treatments, and advanced, yet cost-effective, medical procedures.

- North America, with a projected CAGR of 9.5% through 2030, according to Straits Research, remains the largest aesthetic medicine market globally, expected to reach $83.9 billion over that period. Demand for reconstructive procedures, advanced healthcare facilities, and higher disposable incomes support growth in the region.

- Reports from the American Society of Aesthetic Plastic Surgeons show a steady rise in men opting for minimally invasive procedures across all age groups, driven by the normalization of grooming as a gender-neutral activity. This shift has fueled growing male participation in treatments such as Botox, dermal fillers, and laser hair removal. Med spas and franchisee businesses are increasingly tailoring services to men, offering solutions such as “Bro-tox” and other male-focused treatments.

How is SBC capitalizing on this industry?

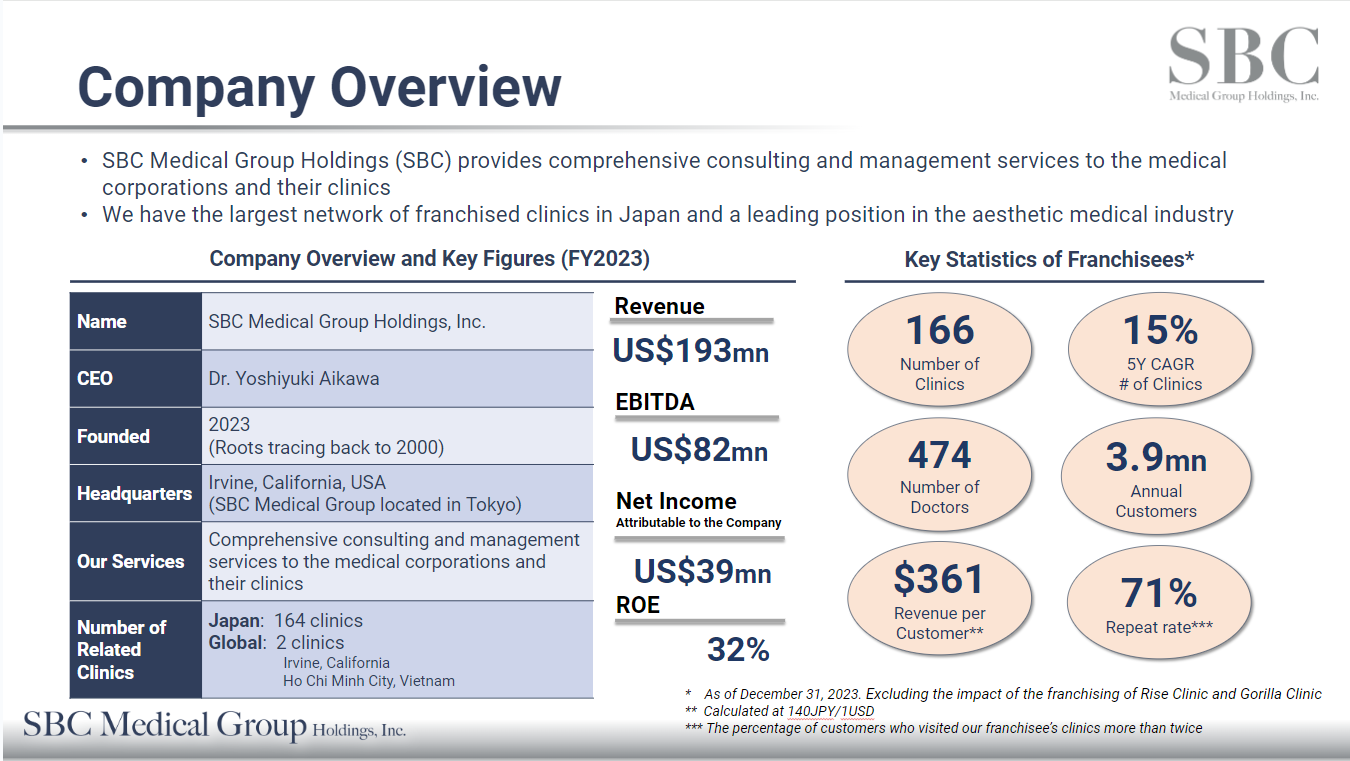

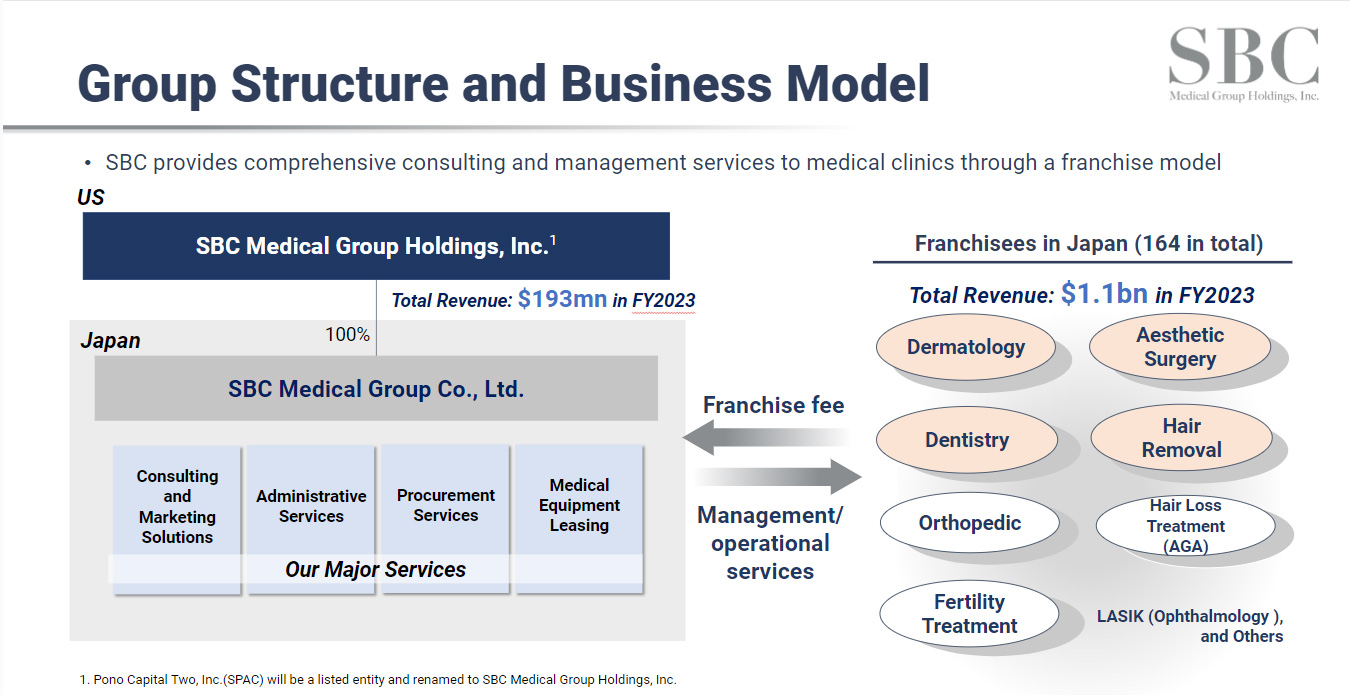

The Company provides comprehensive consulting services to medical clinics through a franchise model. SBC leads the largest network of aesthetic and medical clinics in the country.

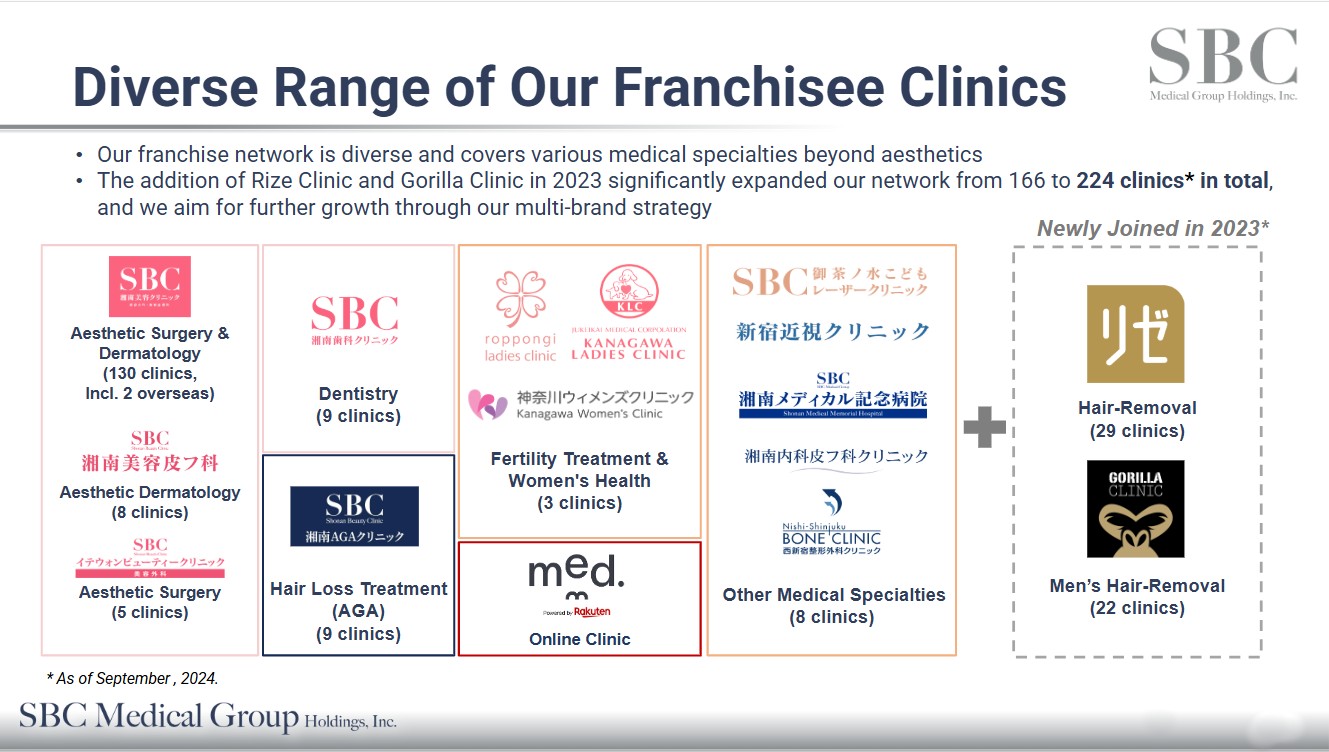

Its franchise network is diverse and covers various medical specialties beyond aesthetics, such as dentistry, AGA (hair loss) treatment, and fertility and women's health. With the addition of Rize Clinic and Gorilla Clinic in 2023, the network has expanded significantly (220 clinics in total, including Rize and Gorilla) and the company is targeting further growth through its multi-brand strategy.

“Attracted by the possibility of beauty treatment that can make people's minds positive through medical treatment, I opened the Shonan Beauty Clinic in Fujisawa in 2000. Beauty treatment at that time was a gray area where the amount of money and the effect of treatment were unclear. This situation has changed considerably over the past 19 years. The negative image of cosmetic surgery has been dispelled, and customers now come to cosmetic surgery clinics with the same ease as when going to a beauty salon. I feel that the world has come to accept that it is quite natural to have medical services such as beauty care to fulfill the desire to "live a positive life by becoming beautiful."

SBC Founder and CEO

Yoshiyuki Aikawa

The Reasons to Have SBC on Your Radar:

- Leading position in Japan's growing aesthetic medical market with the largest customer base. More than 3.9 million customers visited the franchisee clinics in 2023

- Franchisee clinics are experiencing strong revenue growth. Currently, SBC provides services to 166 partner clinics located mainly in Japan. Over the last five years, the franchisees’ revenues have grown at a compound annual growth rate (CAGR) of 24%. With the addition of Rize Clinic and Gorilla Clinic in 2023, the network has expanded significantly (220 clinics in total, as of August 2024). With 10% of Japan's 86.3 million population aged 10-60 currently utilizing aesthetic medicine, SBC has a substantial opportunity to expand its reach in this largely untapped market.

- For the fiscal year ended December 31, 2023, SBC Medical’s revenues increased 11% to $193 million with EBITDA of $8 million and net income of $39 million.

- Total revenues for the nine months ended September 30, 2024 were $160 million, representing an increase of 23% from $131 million in the same period of 2023. Net income for the nine months ended September 30, 2024 was $40.1 million, compared to $24.3 million in the same period of 2023.

- Strong balance sheet with ample leverage capacity for future growth. As of September 30, 2024, SBC Medical maintained a strong liquidity position, with cash and cash equivalents totaling $137.4 million, up from $103.0 million as of December 31, 2023.

- Additional high growth potential in Japan through expansion into adjacent fields and in the growing global aesthetic medicine market: SBC aims to leverage its expertise, expanding into adjacent fields such as fertility treatment, hair loss treatment, and online clinic services. SBC integrated back-office platform is a market leader, with significant potential for B2B partnerships. SBC also has a potential to expand its presence in the global healthcare market, offering a broad range of medical services to its customers, beyond the aesthetic medical market in Japan. The global cosmetics market is projected to hit $205billion in 2030 from $90.37billion in 2023. (Source; Inkwood Research).

- Experienced Management. Led by CEO Dr. Yoshiyuki Aikawa (Harvard Medical School), and an experienced management team focused on building long-term value.

COMPANY OVERVIEW

Diverse Range of Franchisee Clinics

SHINJUKU/TOKYO

UMEDA/OSAKA

IN SUMMARY

Now is one of the best times to have SBC on your radar as investments in Japan heat up.

Japan takes its beauty standards very seriously and this fast growing company is capitalizing on the massive consumer demand, especially as consumers are becoming more empowered and educated.

Straits Research projects that the global medical aesthetics market will grow at a 10% CAGR, reaching $245 billion by 2030. We expect the strong growth to be driven by demographic trends, rising social acceptance, and increasing demand for minimally invasive procedures. Japan’s market, with only 10% penetration, offers significant growth potential for SBC to capitalize on. Meanwhile, SBC is actively working to replicate its successful Japanese model elsewhere in Asia and the United States. The company expects Singapore to become SBC’s Asian business hub outside of Japan following the company’s November 2024 acquisition of Singapore-based Aesthetic Healthcare Holdings.leveraging the country’s advanced medical infrastructure and regulatory environment to facilitate further regional expansion.

The company is financially well positioned to support its expansion efforts. As of September 2024, SBC reported cash and equivalents of $137 million, with long-term debt of $12 million.

Learn More about SBC Medical Group Holdings, Inc. by gaining access to their comprehensive investor presentation

Download Investor Presentation

Contact us

SmallCapsDaily, LLC

1334 Northampton St, Easton, PA 18042

info@smallcapsdaily.com

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

DISCLAIMER

THIS IS A PAID ADVERTISEMENT

NO INVESTMENT ADVICE

SCD Media LLC (d/b/a “Smallcaps Daily”), hereinafter referred to as “Smallcaps Daily,” and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party”. The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation”.

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Smallcaps Daily, its managers, its employees, affiliates, and assigns (collectively the "Publisher") do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

Release of Liability: through use of this website, viewing or using you agree to hold Smallcaps Daily, its operators, owners, and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources that we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Smallcaps Daily encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the company profiled or is available from public sources and Smallcaps Daily makes no representations, warranties, or guarantees as to the accuracy or completeness of the disclosure by the profiled company. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provided herein. Instead, Smallcaps Daily strongly urges you to conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Smallcaps Daily’s full disclosure is to be read and fully understood before using Smallcaps Daily's website, or joining Smallcaps Daily's email or text list. From time to time, Smallcaps Daily will disseminate information about a company via website, email, sms, and other points of media. By viewing Smallcaps Daily's website and/or reading Smallcaps Daily's email or text newsletter you are agreeing to this ----> https://Smallcaps Daily.com/disclaimer/. All potential percentage gains discussed in any communications are based on calculations from the low to the high of the day. We are engaged in the business of marketing and advertising companies for monetary compensation.

If you have questions or concerns about a product you’ve seen in one of our emails, emails, text newsletters or SMS, we encourage you to reach out to that company directly.

Disclaimer – Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated, and edited by the owner of Smallcaps Daily. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to Smallcaps Daily. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Companies with low prices per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website. We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares, we will list the information relevant to the stock and the number of shares here.

COMPENSATION

In compliance with section 17(b) of the Securities Act we are disclosing that we have been compensated a fee pursuant to an agreement between Smallcaps Daily and IA Media LLC (d/b/a/ “IA Media”) hereinafter referred to as IA Media. Small Caps Daily was hired by IA Media for a period beginning September 2024 and ending November 2024 to publicly disseminate information about SBC Medical Group Holdings, Inc., via website, email, and SMS. We were paid up to twenty-five thousand usd via ACH. Readers are advised to review SEC periodic reports: forms 10Q 10K, form 8K, insider reports, forms 3, 4, 5 schedule 13d. Smallcaps Daily is compliant with the CAN-SPAM Act of 2003. Smallcaps Daily does not offer investment advice or analysis, and Smallcaps Daily further urges you to consult your own independent tax, business, financial, and investment advisors. investing in micro-cap, small-cap, and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. The private securities litigation reform act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events, or performance are not statements of historical fact but may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quotes; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results in preparing this publication. Smallcaps Daily has relied upon information supplied by its clients, as well as its clients’ publicly available information and press releases which it believes to be reliable; however, such reliability can not be guaranteed. Investors should not rely on the information contained on this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, Smallcaps Daily and its owners, affiliates, subsidiaries, officers, directors, representatives, and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of material facts from such advertisement. Smallcaps Daily is not responsible for any claims made by the companies advertised herein, nor is Smallcaps Daily responsible for any other promotional firm, its program, or its structure. Smallcaps Daily is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission, or FINRA.

Copyright © 2024 Smallcaps Daily. All rights reserved.