Harnessing the Future of Renewable Energy,

Power Your Portfolio

with SinglePoint's Sustainable Growth!

This little-known Green company is seeing its revenues skyrocket as the trend toward sustainability accelerates.

The future for renewable energy is bright and SinglePoint Inc. (OTCQB: SINGD) may be the SMARTEST way to get your investment portfolio involved in the growing revolution!

There are lots of reasons to be excited about advances in renewable energy. The field is helping to preserve the environment and creating new industries and may even help to make electric cars more affordable.

We use energy every day - to power our homes, turn on the lights, power our cars, and much more. Renewable energy is anticipated to power the future as economies and governments transition to earth-friendly solutions.

North America cannot afford to lose any time in the climate race. The long-term path must be GREEN and public companies in this space stand to benefit immensely from clean-energy initiatives.

Publicly traded SinglePoint Inc. (OTCQB: SINGD) is now standing at the forefront of one of the most tremendous energy shifts in our history!

The death of fossil fuels…

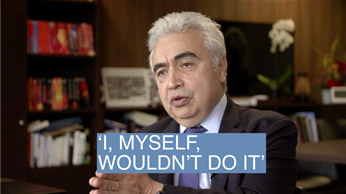

Not that long ago International Energy Agency leader Fatih Birol said in an interview on the global news platform Semafor that he wouldn't invest his own personal pension in fossil-fuel companies!

Birol says the focus of these companies on oil and gas "may not be really profitable" in the medium and longer term, as reputational risks rise, and fossil-fuel investments perhaps become stranded assets.

As Big Oil may start to drag its heels, this is creating opportunities for investors interested in the clean energy transition.

According to Ecofin portfolio manager Michel Sznajer, there will be an acceleration in renewable electricity demand in the U.S. amid electric vehicle and data-center growth, coal plant retirements, and rising adoption of heat pumps. Battery storage to help balance the grid will also be a growth area.

Renewable Energy catalysts include:

- High-interest rates affecting upfront costs of building clean energy projects

- Extreme Heat Across the Nation and rising power prices

- Further declines in solar costs

"Whether you are a socially conscious investor or an investor who sees an investment opportunity from things like climate change, falling costs of renewables and large companies investing in and producing more renewable energy, diversifying your portfolio with renewable energy stocks is a good idea.

Jim Penna Senior manager of retirement services and investment strategy at VectorVest.

What is SinglePoint doing?

SinglePoint, Inc. is a renewable energy and sustainable lifestyle company focused on providing environmentally friendly, energy-efficient, and healthy living solutions.

Still committed to its original focus of modernizing the traditional solar and energy storage model, the company is also actively exploring future growth opportunities and acquiring leaders in:

Solar Engineering, Procurement and Construction

Firms

Solar Engineering, Procurement and Construction

Firms-

Electric vehicle charging

Electric vehicle charging

-

Solar as a subscription service

Solar as a subscription service

-

Air purification

Air purification

TOP TEN Investment Highlights:

-

1.

SinglePoint is acquiring established market leaders primed for high growth. These are proven, yet agile companies that improve the world's environments through renewable energy and health and safety solutions. The company’s goal is to develop or acquire ownership interests in companies with high-growth potential and provide those companies with management services driving growth and profitability.

-

2.

Closing the first acquisition of The Boston Solar Company began the timeline for the company’s up-listing application process to achieve the goal of a future NASDAQ listing!

-

3.

SinglePoint has established industry-leading partnerships to streamline its model

-

4.

SinglePoint is rapidly expanding its national footprint and aims to expand to all 50 states. The company is addressing market fragmentation by rolling up and consolidating to scale sustainably.

-

5.

The growth opportunities in creating safe, clean, and energy-efficient environments are robust, with the solar market alone expected to reach $223B by 2026. There is significant government support which is investing heavily in renewable energy directly through subsidies and tax credits.

-

6.

The U.S. residential solar PV market size was estimated at $9.1 billion in 2020 and is expected to expand at a CAGR of 5.6% from 2021 to 2028. The solar market is driven by favorable policies and regulations for net metering and financial incentives such as the ITC, which provides a 30% tax credit for installing solar systems on residential properties.

-

7.

SinglePointis also emerging as an industry leader in high-proficiency air purification technology. The company offers scientifically proven air purifiers that meet DOE requirements and use certified HEPA filters, as well as conforming to FDA and American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) standards.

-

8.

According to a Market Insights report, the air purifier market is projected to witness a CAGR of 10.8% to almost $2.3 billion by 2023, reaching $2.9 billion by 2025 and $4.8 billion by 2030.

-

9.

SinglePoint has many upcoming value-driving milestones which include planned growth through acquisitions and partnerships as well as expansion into high-value renewable platforms.

-

10.

Revenues are exploding! The company witnessed record revenue in Q1, and demand is robust for its products and solutions. SinglePoint expects to be a high-growth Company for FY2023.

With a focus on people and our planet, SinglePoint Inc. is generating significant business growth as it empowers the next phase of renewable energy!

Growth was Driven Primarily by the Company’s Solar Energy Centric Business Acquisitions.

Strategic Core Energy Assets – Solar EPC’s, Energy Services, Energy Storage

Through SinglePoint’s acquisition of Boston Solar and investment in Frontline Power Solutions, these moves have proven to be quite fortuitous for the company.

Boston Solar is a leading solar installer based in Massachusetts. It was the first of multiple acquisitions the company intends to close on. Boston Solar has been serving the New England market, primarily in Massachusetts, since 2011.

Boston Solar has accumulated several distinctions of recognition of the Company’s outstanding triumphs: Honored with the 2020 Guildmaster Award from GuildQuality, the award acknowledged how Boston Solar demonstrated exceptional customer service within the residential construction industry.

For five consecutive years, the Company was named a Top Solar Contractor by Solar Power World magazine. Further, the Company is applauded by the Boston Business Journal’s “Largest Clean Energy Companies in Massachusetts” list. Boston Solar is a Solar Energy Business Association of New England (SEBANE) member. at: www.bostonsolar.us.

The company is also a proud Boston Red Sox partner and was selected by the baseball team to install a solar system at the new MGM Music Hall at Fenway!

Boston Solar Highlights

- 24.7M in revenue in 2022, up from 17.6M in 2021

- 1,000+ 5-star reviews from customers

- Most experienced installer in MA with 5,000+ installs

- Vertically integrated to create efficiencies

- Recognized as one of the top contractors of the year

- Proud partner of the Boston Red Sox

Serving both residential and business customers, Boston Solar has completed more than 5,000 installations in the last 11 years. Massachusetts leads the nation in solar installations, and Boston Solar has made a significant contribution to that honor.

With a focus on excellence in product, customer service and workmanship, it’s no surprise that the company has more than 1,000 five-star reviews from happy customers. Boston Solar is committed to helping businesses and families achieve energy independence while saving money, supporting the local community and improving the environment.

Frontline Power Solutions (FPS) is a comprehensive energy service Company with the ability to operate in deregulated markets across the country. Frontline Power is licensed in nine states and has applied for and is awaiting final approval in 12 additional states. Frontline provides Energy Supply Agreements to all sizes of commercial, industrial, and institutional properties. In addition to supplying direct agreements, FPS also lends its expertise to its clients to help reduce energy consumption, streamline energy portfolios, and offer other options to lower energy costs.

The strategic acquisition provides SinglePoint with access to an extensive portfolio of clients while giving those FPS clients reciprocal access to one of the nation's leading solar power solutions companies and best-in-class customer service.

There are currently 26 U.S. states that offer deregulated power options which are expected to reach $9 Billion in annual industry revenues!

FPS has been supplying commercial energy contracts to large and small commercial, industrial, institutional, and property management firms. The company facilitates substantial reductions in energy consumption and spending while streamlining logistical management of their energy portfolios. By joining SinglePoint, the two companies benefit from economies of scale and monetizing opportunities more efficiently and quickly.

SinglePoint is firing on all cylinders to improve energy consumption all while building maximum shareholder growth for investors!

How is SinglePoint setting itself apart in the renewable energy race?

By curating a portfolio of renewable energy-focused companies in solar, EV charging, and energy storage. SinglePoint is initially focused on building the largest network of renewable energy solutions and modernizing the traditional solar and energy storage model.

What is the key focus?

To enable the company’s residential and small commercial customers to produce and store some or all their power on-site from solar, thereby relying less on the grid and providing greater resilience, lower emissions, and reduced energy costs.

“Over the next decade, we believe that there will be a continuously rising demand for SinglePoint’s energy services, renewable energy, and battery storage solutions. As homeowners and business owners prepare for the electrification of everything, they will search out and purchase solutions that provide certainty and redundancy related to energy availability, cost, on-site production, and storage. The established trend in increased purchases of EV’s provides organic additional revenue and significant incremental opportunities with our historical, current and future customers as they seek out EV charging solutions which are complementary to our existing products and services.”

Mr. Ralston recently joined a Public.com podcast to discuss the future direction of SinglePoint and the renewable energy sector. The podcast originally aired March 14, 2023.

An Acquisition Plan Aimed for Significant Growth Ahead:

SinglePoint is also actively pursuing additional acquisition targets to expand its footprint and gain additional market share. The company plans to continue expanding its operational footprint as it acquires additional full-service solar EPC (Engineering, Procurement & Construction) companies throughout the nation.

The Company is targeting established solar companies in specific markets that can complement each other and yield synergies and economies of scale.

With recent government funding initiatives announced and periodic interruptions to the power grid, homeowners, business owners, and small commercial owners are searching for ways to ensure that they have access to constant and dependable power!

Strategic Spin Off – K-12 and Commercial Indoor Air Quality, Safety and Security:

- BOX Pure Air (Certified HEPA Indoor Air Purification (IAQ) & BPA Solutions (Building Security, IAQ Improvement, Consulting)

- LifeShield+ – Bullet Resistant window coverings, and door panels exclusive for the K-12 education industry

Clean Indoor Air and safe, secure environments are essential rights of students, teachers, staff and corporate employees. These rights can no longer be ignored and there is a significant long-term opportunity for BPA solutions in this market sector.

BPA markets and sells USA-manufactured portable Certified HEPA air purification units for commercial and industrial use have been purposefully designed as a utility-like appliance to enhance indoor air quality (IAQ) in any locations including schools, offices, and churches. These portable air certified HEPA purification and filtration units are primarily being used in K-12 schools across multiple states.

BOX Pure Air has supplied orders to schools throughout the country, including North Carolina, South Carolina, Texas, California, and others. Additionally, BOX Pure Air has been granted an initial $5.0 million ESSER II GAN (“Grant Award Notification”) from the State of California CDE to distribute portable air purification units in non-public schools. The majority of the initial $121 billion designated for schools to improve ventilation and Indoor Air Quality (IAQ) has yet to be spent and BPA is well positioned to take advantage of the available federal government funding (now estimated at nearly $500 Billion) )to improve indoor air quality.

In addition, there are numerous federal, state and local initiatives and legislative actions being proposed to increase and bolster school and workplace safety with enhanced physical security solutions such as the LifeShield+ ballistic barrier products.

“I have made it a priority to explore all options to strategically reposition, spin off or sell Company assets in an effort to unlock enterprise value at each subsidiary and most importantly increase opportunities to enhance future shareholder returns. Both our energy centric business and our indoor air purification and safety solutions are in long term multi-year emerging markets but, in our opinion, could benefit from the dedicated focus that strategic spin offs can provide to both business plans and shareholders. We are continuing to evaluate the existing landscape and market to be able to grow our energy centric businesses and find the appropriate go-forward structure for our non-energy related business units.”

Is Renewable Energy the Future?

Energy demand is rising with the growth of the global population. With that, there is one question that arises in the mind of investors: Is it good to invest in renewable energy? Many would say yes.

Clean energy is becoming increasingly economical due to the falling costs of solar panels, wind turbines, and batteries for energy storage. That's making the sector a more attractive investment opportunity.

Global warming and climate change are major concerns for the world at present. The use of non-renewable energy sources like fossil fuels like coal, gas, oil, and nuclear energy, is the cause of many environmental changes such as the recent heat waves.

According to a recent study, if emissions continue to rise and are not controlled, the atmosphere will warm by approximately 2.7 degrees Fahrenheit above pre-industrial levels by 2040!

Fossil fuels are also limited, and they have unpredictable costs. Moreover, the governments of many countries have started investing in the renewable energy sector. All these activities have increased growth opportunities in this sector. Government policies regarding climate change and the use of renewable energy are becoming stringent.

Residential Rooftop Solar will continue to benefit from the passage of the landmark US Inflation Reduction Act of 2022 (IRA) which provides $369 Billion in spending for climate and energy measures!

The residential solar market size in the US will grow by $6.67 Billion between 2021 and 2026.

Abigail Ross Hopper, president, and CEO of the Solar Energy Industries Association has dubbed the next 10 years as the “Solar + decade,” as solar and energy storage buildout is expected to continue to build momentum over the next 10+ years. Solar+ Battery Storage market in the US is set for multi-year growth due to the provisions in the IRA.

In summary…

future is evidently looking green and SinglePoint Inc. (OTCQB: SINGD) may be one of the brightest renewable energy companies going under Wall Street’s radar!

The company has made substantial and successful progress in the past few years and is continuing their aggressive focus on the accretive opportunities within the energy and energy storage sector.

SinglePoint’s immediate goal is to recognize value from the non-core assets in the company’s portfolio while it continues to prioritize, build, and add to its energy centric businesses.

By continuing to focus on this energy-centric strategy the company has delivered record gross revenue for FY2022 of $21.8 Million while attracting interest from several companies that closely align with and will deliver continuing positive results for years to come!

The landmark Inflation Reduction Act (IRA) has changed the trajectory of the U.S. energy market, sparking a projected five-fold increase in the size of America’s $33 Billion solar and storage industry over the next decade. This increases the near-term opportunity for SinglePoint’s strategic Solar EPC and Energy Storage acquisition strategy!

As the market share for fossil fuels is likely to keep falling and the nation continues to spend huge sums on green energy projects, SinglePoint Inc. (OTCQB: SINGD) is doing its part to help save our environment all while building maximum shareholder value!